Summary: Medicare Part C is offered by private insurance companies and covers your Original Medicare benefits. Also known as Medicare Advantage plans, Medicare Part C can provide additional coverage options for Medicare enrollees. Learn more about Medicare Part C plan types, coverage, and more. Estimated Read Time: 6 min

What is Medicare Part C?

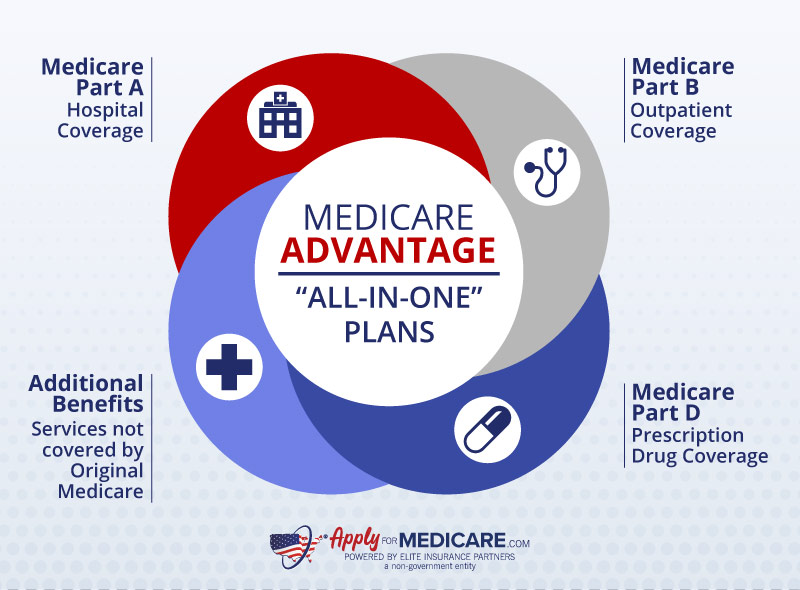

Medicare Part C, also known as a Medicare Advantage plan, is a Medicare-approved health plan offered by private insurance companies that provides the same hospital and medical coverage in place of Original Medicare. Companies offering Medicare Advantage plans must follow rules set by Medicare and offer at least the same coverage as Original Medicare. However, many plans provide additional coverage, such as prescription drug coverage and other benefits, depending on the plan you choose to enroll in.

Medicare Part C has changed considerably over the years. In 1997, the Balanced Budget Act delivered Medicare Part C under its original name: the Medicare+Choice (M+C) program. At this time, multiple healthcare plans, including HMOs and PPOs, became available under Medicare+Choice.

In 2003, Medicare Part C became known as Medicare Advantage after the Medicare Prescription Drug, Improvement, and Modernization Act (MMA) was passed. This legislation allowed Medicare Part C to offer prescription drug coverage.

Over the past few years, the number of Medicare Advantage plans available nationwide has grown substantially. As a result, most Medicare beneficiaries who want to enroll in a Medicare Advantage plan have multiple plans to choose from. Below, we’ll explain how Medicare Part C works so you can make an educated decision about your healthcare coverage.

How Does Medicare Part C Work?

Medicare Part C works similarly to health insurance you may have had while employed with a few significant differences. Though Medicare Advantage plans (Part C) are offered by private insurers, they must follow rules set by Medicare. This is because Medicare pays a fixed amount for your coverage each month to the plan’s provider.

You must have both Medicare Part A and Medicare Part B to enroll in Medicare Part C. Once enrolled, your Medicare Advantage plan will pay for your healthcare services in place of Original Medicare. Though your Medicare Advantage plan will be responsible for paying for your healthcare, you don’t “lose” Original Medicare. You will still be responsible for paying your Medicare Part B premium in addition to your Medicare Part C premium. You can also choose to return to Original Medicare during an appropriate enrollment period if you no longer want to be enrolled in a Medicare Advantage plan.

If you want to sign up for Medicare Part C, you can do so without worrying about being denied coverage due to pre-existing conditions. Unlike Medicare Supplement plans, Medicare Advantage plans do not require medical underwriting, regardless of when you choose to enroll.

Even though Medicare Advantage plans must follow rules set by Medicare, covered services and out-of-pocket costs will vary from plan to plan. Additionally, when you’re enrolled in Medicare Part C, you cannot have a Medicare Supplement plan or, in most cases, a standalone Medicare Part D plan. Before enrolling in a Medicare Advantage plan, make sure the plan fulfills your healthcare and budgeting needs.

What are the Difference Types of Medicare Advantage Plans?

The are four primary types of Medicare Advantage plans: HMO, PPO, PFFS, and SNP. Though the plans have some similarities, it is important to understand the differences between each plan. Every Medicare Advantage plan will provide your Medicare Part A and Medicare Part B coverage; however, some plans may offer additional benefits. Below, we’ll briefly review each type of Medicare Advantage plan.

Medicare Advantage Health Maintenance Organization (HMO) Plans

Health Maintenance Organizations (HMO) plans provide coverage within a network and usually require you to choose a primary care doctor within that network. Your primary care doctor will help coordinate your care by submitting referrals and authorization requests. Many HMO plans include prescription coverage.

Things to know about HMO plans:

- For most HMO plans, you need to choose a primary care doctor

- In most cases, you’ll need to get a referral to see a specialist if you have an HMO plan

- HMO plans can’t charge more than Original Medicare for certain services such as chemotherapy and dialysis

Some HMO plans, known as HMO Point-of-Service (HMOPOS) plans, allow you to receive some services out-of-network for a higher cost. You may be required to get prior approval for certain services when using providers outside of your plan’s network.

Medicare Advantage Preferred Provider Organization (PPO) Plans

Preferred Provider Organization (PPO) plans give you the flexibility of going to any healthcare provider who accepts Medicare. Your costs will be lower if you go to a provider or facility that is within your plan’s network, however, you have the option to go outside of the network (you’ll typically pay more).

Things to know about PPO plans:

- Prescription drug coverage is included in most PPO plans

- You do not need to choose a primary care doctor and don’t need referrals for specialists

- PPO plans allow you to use providers outside of the plan network as long as they are participating in Medicare

Whenever you receive care out-of-network, you’ll want to check with your PPO plan to ensure your service is deemed medically necessary and is covered. PPO plans will always cover emergency and urgent care.

Medicare Advantage Private Fee-for-Service (PFFS) Plans

Private Fee-for-Service (PFFS) plans generally do not have networks and allow you to see any healthcare provider who accepts Medicare and accepts the payment terms of your PFFS plan. If your PFFS plan does have a network, you can still choose an out-of-network provider who accepts the plan’s terms, however you will pay more.

Things to know about PFFS plans:

- If your PFFS plan does not offer drug coverage, you may enroll in a separate Medicare Part D prescription drug plan

- PFFS plans determine how much you pay for covered services.

- Your provider must agree to accept the plan’s terms and conditions of payment

Medicare Advantage Special Needs Plans (SNP)

Special Needs Plans provide coverage for people with certain diseases, certain healthcare needs, or those receiving Medicaid benefits. In addition to covering your Medicare Part A and Medicare Part B benefits, Special Needs Plans may also provide extra tailored coverage for the groups they serve.

Things to know about SNPs:

- Special Needs plans are either HMO or PPO plan types

- To enroll in a Special Needs plan, you must meet the eligibility requirements for one of the 3 types of SNPs

- All SNPs must provide prescription drug coverage

In addition to the four main types of Medicare Advantage plans, there are also Medicare Medical Savings Account (MSA) plans. MSAs are like Health Savings Accounts (HSAs) that you would enroll in through an employer. These plans consist of two parts: a high-deductible Medicare Advantage plan and a medical savings account. Only a handful of insurance companies offer Medicare Medical Savings Account plans, so you may not have a MSA plan available in your area.

What Does Medicare Part C Cover?

The coverage you receive from your Medicare Advantage plan will vary from plan to plan and carrier to carrier. At a minimum, Medicare Part C must provide all your Medicare Part A and Part B benefits. It’s worth noting that Medicare Part C does not cover clinical trials or hospice services.

In addition to Original Medicare benefits, Medicare Advantage plans may offer additional coverage depending on the plan and carrier. Medicare Advantage plans may offer prescription drug coverage and other services that are not covered by Original Medicare (Medicare Part A and Part B). Plans may also cover services that promote your overall health and wellness. Since Medicare Advantage plan coverage can vary greatly, always double-check a plan’s benefits and limitations before enrolling.

How Much Does Medicare Part C Cost?

Since Medicare Part C is offered by private insurance companies, costs can vary greatly between plans and carriers. Depending on which plans are available in your area, some Medicare Advantage plans may have monthly premiums as low as $0. Keep in mind that in addition to your Medicare Advantage plan premium, you will also be responsible for paying your Medicare Part B premium each month.

When comparing Medicare Advantage plan costs, you will not only want to look at the plan premium, but also at the plan’s MOOP. The maximum out-of-pocket (MOOP) limit is an annual out-of-pocket limit that is set for each plan. After meeting your plan’s MOOP, you will not have to pay out-of-pocket expenses for your Medicare-covered services for the remainder of the year.

For 2025, Medicare Advantage plans cannot have a maximum out-of-pocket limit of more than $9,350 for in-network services. Though plans cannot exceed that amount, plans may offer a MOOP that is less. To avoid straining your budget with out-of-pocket medical expenses, it’s essential to review maximum out-of-pocket limits when comparing plans.

Premiums, deductibles, copayments, and coinsurance amounts for Medicare Advantage plans can change each year. When you’re enrolled in Medicare Part C, you’ll be mailed an Annual Notice of Change before September 30th that will detail any coverage and cost changes going into effect on January 1st.

How to Get Medicare Part C

If a Medicare Advantage plan sounds like the right option for you, there are a few things you must do before applying for Medicare Part C. First, to enroll in Medicare Part C, you must be enrolled in both Medicare Part A and Part B (Original Medicare). If you’re eligible for Medicare but haven’t enrolled, you must do so through the Social Security Administration.

You’ll need to have your Medicare number and the coverage start dates of your Original Medicare when you sign up for a Medicare Advantage plan. This information can be found on your Medicare card or by visiting Medicare.gov.

Since private insurance companies offer Medicare Part C, you’ll want to find and compare plans available in your area. Medicare Advantage plans differ from carrier to carrier and plan to plan. When comparing plans, ensure that any physicians you see are in the plan’s network.

If you are looking into getting a Medicare Advantage plan with prescription drug coverage, you’ll want to make sure any prescriptions you are currently taking are on the plan’s formulary.

Pros and Cons of Medicare Advantage Plans

There are many pros and cons to consider when determining if Medicare Part C is suitable for you. When considering whether to enroll in a Medicare Advantage plan, consider your budget, healthcare needs, and the providers you currently see.

Many Medicare Advantage plans may have low to no monthly premiums, which makes them a popular option for individuals with a limited budget. They also have a yearly limit on how much you can pay out-of-pocket (MOOP). Additionally, although Medicare Advantage plans are required to provide the same coverage as Medicare Parts A and B, some plans may offer additional coverage.

| Medicare Part C Advantages | Medicare Part C Disadvantages |

|---|---|

| Some Plans may have lower out-of-pocket costs than Original Medicare | You must use a doctor within your plan’s network |

| Plans may offer additional coverage | You may need a referral to use a specialist |

| Plans have a yearly limit on what you pay out of pocket (MOOP) | You often must get a service approved ahead of time for the plan to cover it |

| Many plans provide drug coverage | Plans can have high out-of-pocket costs |

There are a few disadvantages to enrolling in Medicare Part C compared to keeping Original Medicare and getting a Medigap plan. Since private insurance companies offer Medicare Advantage plans, you may only be able to use your benefits at doctors and providers within your plan’s network. There are also many instances where you are required to receive referrals and approvals before getting certain services or supplies.

Though Medicare Advantage plans have an annual out-of-pocket limit, individual out-of-pocket costs tend to be higher than Original Medicare. Some plans have high deductibles and may charge higher copayments and coinsurance for hospital and outpatient care.

Is a Medicare Advantage Plan the Right Option for Me?

We understand that choosing the right Medicare coverage can be difficult. When it comes to healthcare coverage, it’s important to choose coverage that fulfills your healthcare needs while staying within your budget.

You can learn more about what services are covered by Medicare Advantage plans and how much you’ll need to pay out of pocket by checking out our links below. If you still have questions regarding Advantage plans, give our team of licensed insurance agents a call at the number above. We strive to give Medicare enrollees the tools they need to make an informed decision about their healthcare coverage.

Does a Medicare Advantage plan sound right for you? Learn more about the Medicare Part C application process here.

Medicare Part C covers your Original Medicare benefits. Learn which services and supplies are covered here.

Medicare Advantage Open Enrollment Period

If you’re enrolled in a Medicare Advantage plan, it’s important to understand the Medicare Advantage Open Enrollment Period.

Sources

An Economic History of Medicare Part C, National Library of Medicine. Accessed July 2023

https://www.ncbi.nlm.nih.gov/pmc/articles/PMC3117270/

Health Plans – General Information, Centers for Medicare & Medicaid Services. Accessed July 2023.

https://www.cms.gov/medicare/health-plans/healthplansgeninfo

Medicare and You, Medicare. Accessed July 2023

https://www.medicare.gov/publications/10050-Medicare-and-You.pdf

Your Coverage Options, Medicare. Accessed July 2023.

https://www.medicare.gov/health-drug-plans/health-plans/your-coverage-options