Summary: The first opportunity to enroll in Medicare occurs during the Medicare Initial Enrollment Period. During this seven-month enrollment period, eligible individuals can enroll in Original Medicare, as well as supplemental coverage such as a Medicare Part D plan. In this article, we’ll explain how the Initial Enrollment Period works and give you the tools to calculate your Medicare IEP. Estimated Read Time: 5 min

What is the Initial Enrollment Period for Medicare?

The Medicare Initial Enrollment Period is your first opportunity to enroll in Medicare coverage. This enrollment period is unique to each person and will generally only occur once in your lifetime.

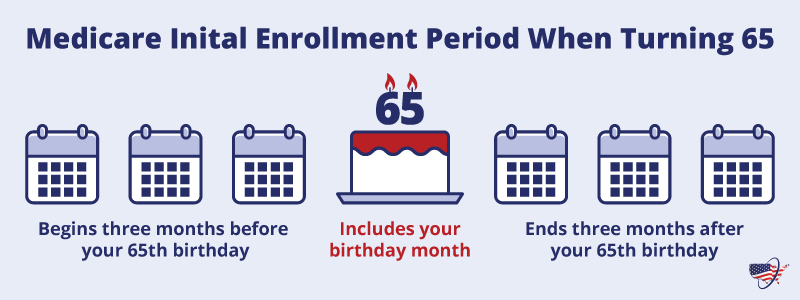

Your Medicare Initial Enrollment Period (IEP) is a seven-month period that begins three months before you become eligible for Medicare and ends three months after.

If you’re turning 65 your Medicare IEP begins three months before you turn 65, includes the month of your birthday, and will end three months after. If your birthday is on the 1st of the month, your Initial Enrollment Period will begin four months before the month you turn 65, includes your birthday month, and ends two months after.

If you are receiving disability benefits your Initial Enrollment Period for Medicare begins three months before you receive your 24th disability benefit and ends three months after.

During your Initial Enrollment Period, you can sign up for Original Medicare and explore additional coverage options such as Medicare Part D Prescription Drug Plans. Signing up for Original Medicare during your IEP is especially important for individuals who do not have other healthcare coverage; missing your IEP can result in a late enrollment penalty and a lapse in healthcare coverage.

Medicare Initial Enrollment Period Calculator

To figure out when your Initial Enrollment Period for Medicare will occur, you must first know when you will become eligible for Medicare coverage. Use the Medicare IEP calculator below to find out your Medicare eligibility date. Your Initial Enrollment Period begins three months before your eligibility date and ends three months after.

Medicare Eligibility Calculator

Follow the steps prompted by the tool to understand your Medicare Eligibility date.

Now that you know when you will be eligible for Medicare, refer to the chart below to find your Initial Enrollment Period.

| Month You Become Eligible | Initial Enrollment Period Start | Initial Enrollment Period End |

|---|---|---|

| January | October | April |

| February | November | May |

| March | December | June |

| April | January | July |

| May | February | August |

| June | March | September |

| July | April | October |

| August | May | November |

| September | June | December |

| October | July | January |

| November | August | February |

| December | September | March |

The start of your Initial Enrollment Period occurs on the 1st of the month, and the end of your Initial Enrollment Period occurs on the last day of the month. For example, if your 65th birthday is on May 13th, your Medicare IEP will start on February 1st and end on August 31st.

If your eligibility date falls on the first day of the month, your Initial Enrollment Period will begin four months before the month you become eligible and end two months after.

Who Gets More Than One Medicare Initial Enrollment Period?

If you are receiving disability benefits from Social Security or the Railroad Retirement Board, you may receive two Initial Enrollment Periods.

Your first Initial Enrollment Period will occur when you first become eligible for Medicare due to disability. For many, this will be when you have received disability benefits for 24 months.

Individuals who get Medicare due to a disability under the age of 65 will receive a second Initial Enrollment Period when they turn 65.

Since supplemental coverage options are limited for Medicare enrollees under the age of 65, the second Initial Enrollment Period allows you to sign up for coverage that you previously did not have access to.

Enrolling in Original Medicare During the Initial Enrollment Period

During your Initial Enrollment Period, you will be able to enroll in both parts of Original Medicare: Medicare Part A and Medicare Part B. If you are already receiving Social Security or Railroad Retirement Board benefits, you will be automatically enrolled in Medicare once you turn 65. Even if you’re automatically enrolled in Medicare, you will still have an Initial Enrollment Period during which you can make choices regarding your coverage.

If you are still working when you become eligible for Medicare, you will be responsible for signing up for Medicare yourself. Enrolling in Medicare during your Initial Enrollment Period can help ensure you don’t have a lapse in healthcare coverage, and you don’t incur any late enrollment penalties.

It is recommended to begin the enrollment process early in your Initial Enrollment Period because applications can take up to four weeks to be approved.

The date your Medicare Part A and Part B coverage begins depends on when you sign up for Medicare. If you enroll during the three months prior to your 65th birthday, your Medicare benefits will begin on the first day of your 65th birth month. If you enroll during the month of your 65th birthday or any of the three months following your birthday, your coverage will start on the first day of the following month.

| Enrolled On: | Coverage Start: |

|---|---|

| The 3 months before your 65th birthday | The 1st day of your birthday month |

| The month of your 65th birthday | 1 month after your birthday |

| The 1st month after your birthday | 2 months after your birthday |

| The 2nd month after your birthday | 3 months after your birthday |

| The 3rd month after your birthday | 4 months after your birthday |

Medicare Part D Initial Enrollment Period

The Medicare Part D Initial Enrollment Period is the same as your Initial Enrollment Period for Original Medicare. During this time, you can enroll in a standalone Medicare Part D drug plan, also known as a Medicare PDP. Before signing up for a drug plan during your Medicare Part D IEP, you need to first enroll in at least one part of Original Medicare. You will not be eligible for Medicare Part D unless you have Medicare Part A and/or Part B.

If you do not enroll in a Medicare Part D plan during your Initial Enrollment Period, you will need to wait until the Annual Enrollment Period to apply for Medicare Part D coverage. Waiting to enroll in drug coverage, without having other creditable coverage, can result in a Medicare Part D late enrollment penalty.

How to Apply for Medicare Using Your Initial Enrollment Period

Applying for Medicare using your Initial Enrollment period is simple. During this window, you can apply online at the Social Security website, over the phone, or in person at your local Social Security office. You can learn more about the application process by checking out our resources below.

Is your Initial Enrollment Period approaching? Learn more about the process of signing up for Medicare coverage here.

Documents You’ll Need for Medicare Enrollment

Get a jump start on Medicare enrollment by getting your documents together ahead of your Medicare IEP.

What are Medicare Late Enrollment Penalties?

Signing up for coverage outside of your Initial Enrollment Penalty can result in penalties. Learn more about late enrollment penalties here.

Sources

5 Things you Need to Know About Signing Up for Medicare, CMS.gov. Accessed January 2024