Summary: Medicare covers a variety of services related to diagnosing and treating cancer. In this article, we’ll review which cancer screening and preventative services Medicare covers. We’ll also review which cancer treatments are covered under Medicare and how to get additional coverage to help with your costs. Estimated Read Time: 9 min

The Impact of Cancer in Older Adults

Cancer is a disease that affects people of all ages and can significantly impact your life. Older adults may find themselves worrying more about cancer as they age. The Centers for Disease Control and Prevention states that increasing age is one of the most critical risk factors for cancer. In their U.S. Cancer Statistics report for 2019, the CDC reports that 58% of cancers were found in adults aged 65 years or older.

Fortunately, we continue to see advancements in cancer treatment and tests and procedures used to detect cancer early. Medicare beneficiaries will be able to use their benefits for cancer screenings, preventative services, and treatment if they are diagnosed.

Below, we’ll explain which services are covered by Medicare and how you can get additional coverage to ease the financial burden of cancer treatment.

Medicare Coverage for Cancer Screening and Preventative Services

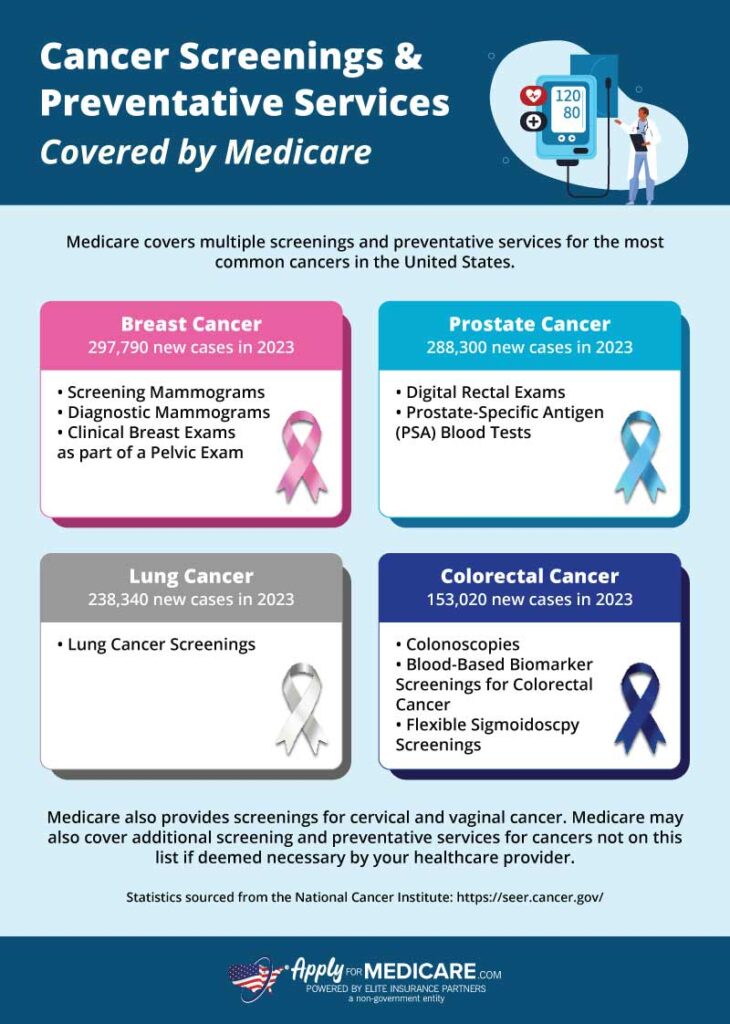

Medicare provides coverage for several preventative and screening services for cancer. Early detection and diagnosis can significantly impact how successful cancer treatment is. Cancer screenings and preventative services are billed through your Medicare Part B. In most cases, if the doctor accepts Medicare assignment, you won’t have any out-of-pocket costs when receiving these preventative services.

Cancer screenings and preventative services that Medicare covers include:

Mammograms – Medicare Part B will cover screening mammograms once every 12 months for women ages 40 or older. Diagnostic mammograms can be done more frequently if deemed medically necessary by your doctor. You will pay nothing out-of-pocket for screening mammograms. However, diagnostic mammograms will have a 20% coinsurance you must pay after meeting your Medicare Part B deductible.

Prostate Cancer Screenings – Medicare Part B will cover digital rectal exams and prostate-specific antigen (PSA) blood tests once every 12 months if you’re a man over 50. Medicare fully covers PSA blood tests unless your doctor doesn’t accept assignment. Digital rectal exams will come with a 20% coinsurance after meeting your Medicare Part B deductible.

Lung Cancer Screenings – Medicare Part B provides coverage for lung cancer screenings once a year if you meet specific requirements. These screenings are only covered for individuals between ages 50 and 77 who are current smokers or quit smoking within the last 15 years. You must also get an order from your doctor or other health care professional. Lung cancer screenings come at no cost to you if your doctor accepts Medicare assignment.

Colonoscopies – Screening colonoscopies are covered by Medicare Part B, typically at no cost to beneficiaries. Individuals who are at high risk of colorectal cancer will have colonoscopies covered every 24 months. Individuals who aren’t high risk will receive coverage for colonoscopies every 120 months. Typically, you pay nothing if your doctor accepts assignment, however, there are exceptions:

- You’ll pay a 15% coinsurance if your doctor finds and removes a polyp or other tissue during your colonoscopy.

- If you are in a hospital outpatient setting or ambulatory surgical center, you will need to pay the facility a 15% coinsurance.

- Your Medicare Part B deductible does not apply in the above circumstances.

Other Colorectal Cancer Screening Services – In addition to colonoscopies and blood-based biomarker screenings, Medicare also provides the following preventative services for colorectal cancer:

- Multi-target Stool DNA Tests – covered by Medicare once every three years if you are between the ages of 45-85, show no signs of colorectal disease, and are at average risk for developing colorectal cancer.

- Blood-Based Biomarker Screening for Colorectal Cancer – this blood-based biomarker lab test is covered by Medicare Part B for individuals who are between the ages of 45 and 85, show no signs of colorectal disease, and are at average risk of developing colorectal cancer. Medicare will cover this test once every three years if you continue to meet the requirements.

- Flexible Sigmoidoscopy Screenings – Medicare Part B covers flexible sigmoidoscopy screenings once every 48 months for most people who are 45 years of age or older.

Cervical and Vaginal Cancer Screenings – Screenings for cervical and vaginal cancers are covered by Medicare including pap test and pelvic exams. For most individuals, Medicare covers these screenings and exams once every 24 months. As part of your pelvic exam, Medicare will also cover a clinical breast exam to check for breast cancer. If your health care provider accepts assignment, you pay nothing for these services.

Medicare Coverage for Cancer Treatment

Medicare covers medically necessary cancer treatments, including chemotherapy, radiation therapy, and more. If you have Original Medicare, you can receive treatment at any hospital, doctor’s office, or freestanding clinic that accepts Medicare. You can help reduce your out-of-pocket costs by ensuring your health care providers accept Medicare assignment.

If you have a Medicare Advantage plan, it must cover all cancer treatments, screenings, and preventative services that are covered by Original Medicare (Part A and Part B). Depending on your plan, you may receive coverage for additional services that Medicare does not typically cover. You may be restricted to a network of doctors and hospitals, which you must use to receive coverage. Review your plan for more information.

Your costs for certain cancer treatments will depend on how they are billed. Some treatments will be billed through your Medicare Part A, while others will be billed through your Medicare Part B. Refer to the chart below for a basic summary of how the different parts of Medicare are billed when receiving treatment for cancer.

| Part of Medicare | How it Works with Cancer Treatments |

|---|---|

| Medicare Part A | Covers cancer treatment that is received while you’re an inpatient at a hospital. |

| Medicare Part B | Covers cancer treatment that is received if you’re a hospital outpatient or a patient in a doctor’s office. |

| Medicare Part D | Covers some oral prescription drugs for chemotherapy, and other drugs used during your cancer treatment (such as pain medication) |

Below, we’ll go into more detail about different treatments and how they are handled by Medicare.

Chemotherapy

Chemotherapy for cancer is covered by Medicare. Whether your Medicare Part A or Medicare Part B will be billed will depend on whether you are receiving chemotherapy as a hospital inpatient or if you are receiving treatment as an outpatient. If you receive chemo at a doctor’s office or outpatient clinic, your treatment will be billed to your Medicare Part B. When receiving treatment at a doctor’s office or freestanding clinic, you will be responsible for paying 20% of the Medicare-approved amount after meeting your Medicare Part B deductible.

Radiation Therapy

Like chemotherapy, Medicare does cover radiation therapy, but your costs will depend on whether you’re an inpatient or an outpatient. As an inpatient, you will need to pay your Medicare Part A deductible and coinsurance, if applicable. As an outpatient, you will need to pay the 20% Medicare Part B coinsurance (after meeting your deductible).

Immunotherapy

Though immunotherapy isn’t used as frequently as chemotherapy or radiation when it comes to treating cancer, Medicare will cover immunotherapy that’s medically necessary for your treatment. How much you pay for immunotherapy will depend on how you receive your care. For example, immunotherapy drugs administered in an outpatient setting will be billed to your Medicare Part B and you will be responsible paying for your 20% coinsurance.

Cancer Drugs

Cancer drugs deemed medically necessary by your doctor are covered by Medicare. However, some cancer drugs will be covered by Medicare Part B, while others will be covered by Medicare Part D. Cancer drugs given in an outpatient setting such as a doctor’s office or outpatient facility are covered under Medicare Part B. This includes drugs given intravenously as well as oral medications given as part of treatment in an outpatient facility.

Medicare Part D provides coverage for medications related to your cancer treatment that are taken at home. Medicare Part D Prescription Drug plans are required to cover most drugs in certain protected classes, such as cancer drugs. Review your Medicare Part D drug formulary to see which drugs are covered and how much your costs will be. If you do not have drug coverage through a standalone Part D plan or a Medicare Advantage plan, you will have to pay for these medications out-of-pocket.

Home Health Care for Cancer Patients

Medicare Part A covers home health care services if you are homebound due to cancer. Medicare will cover part-time or intermittent skilled nursing care as well as in-home physical therapy and occupational therapy. You must have a face-to-face visit with your doctor or health care provider before they can certify that you need home health care. It’s important to note that covered home health care services does not include 24-hour-a-day care or homemaker services. If you need more than intermittent nursing care, you may not be eligible. Speak with your doctor about your needs to find out whether home health care would be covered for you.

What is Cancer Insurance and How Can It Help with Costs?

Cancer insurance is a supplemental insurance policy that help cover expenses that Medicare or other insurance may not cover. These policies do not replace Medicare but instead work as a supplemental benefit that exists alongside your health insurance.

Cancer insurance policies are offered by private insurance companies and premiums can range from $10 to $50 a month. Unlike traditional insurance plans, cancer insurance policies pay benefits directly to the policyholder. This means that instead of your insurance plan paying a hospital or doctor, they pay the money to you.

There are two different types of cancer insurance plans: lump sum policies and scheduled benefits policies. A lump sum policy will pay a lump sum of money to you once you receive a cancer diagnosis. You can use this money to help pay for expenses while undergoing cancer treatment such as copayments, coinsurance, and even non-medical expenses, such as groceries or utilities.

A scheduled benefits policy pays predetermined amounts when you have specific cancer treatments. For example, you may receive a certain amount when you undergo surgery and another sum when you receive chemotherapy.

Though Medicare provides coverage for many services related to cancer treatment, out-of-pocket costs can still add up. Cancer insurance can help ease the financial burden of Medicare beneficiaries who get diagnosed with and undergo treatment for cancer. If cancer runs in your family, or you have a health history that puts you at higher risk for cancer, you may consider picking up a cancer insurance policy.

Other Options for Getting Help with Cancer Treatment Costs

When receiving treatment for cancer, your focus should be on your health and not your finances. Unfortunately, even with cancer coverage, you may still be burdened with out-of-pocket costs. Fortunately, there are a few ways to reduce your expenses when using your Medicare coverage for cancer treatment.

- Medicare Supplement Plans, also known as Medigap, help cover costs left behind by Original Medicare. This can include copayments, coinsurance, and deductibles. Suppose you have a family history of cancer, or have received treatment for cancer in the past. In that case, you may consider signing up for a Medigap plan during your Medicare Supplement Open Enrollment Period.

- You may be eligible for a Medicare Advantage Chronic Condition Special Needs Plan. These plans have benefits tailored to meet the needs of the groups they serve. A Special Needs Plan may offer additional coverage for services that cancer patients commonly need.

- Local resources may be available to individuals who are diagnosed with cancer and are struggling to pay their out-of-pocket costs. Organizations like CancerCare have professional oncology social workers who can help cancer patients find resources while providing cancer-focused guidance.

Sources

U.S. Cancer Statistics: Highlights from 2019 Incidence

https://www.cdc.gov/cancer/uscs/about/data-briefs/no29-USCS-highlights-2019-incidence.htm

Preventative & Screening Services, Medicare.gov. Accessed December 2023

https://www.medicare.gov/coverage/preventive-screening-services

Medicare Coverage of Cancer Treatment Services, Centers for Medicare & Medicaid Services. Accessed December 2023

https://www.medicare.gov/Pubs/pdf/11931-Cancer-Treatment-Services.pdf

Cancer Insurance, Healthinsurance.org. Accessed December 2023

https://www.healthinsurance.org/supplemental-products/cancer-insurance/