Summary: Medicare Part C provides inpatient and outpatient coverage in place of Original Medicare. Medicare Advantage plans (Part C) may provide additional coverage options for services that aren’t covered by Original Medicare. Below, we’ll discuss which services are covered by Medicare Part C and provide helpful tips on navigating coverage options offered by Medicare Advantage plans. Estimated Read Time: 6 min

What Does Medicare Part C Cover?

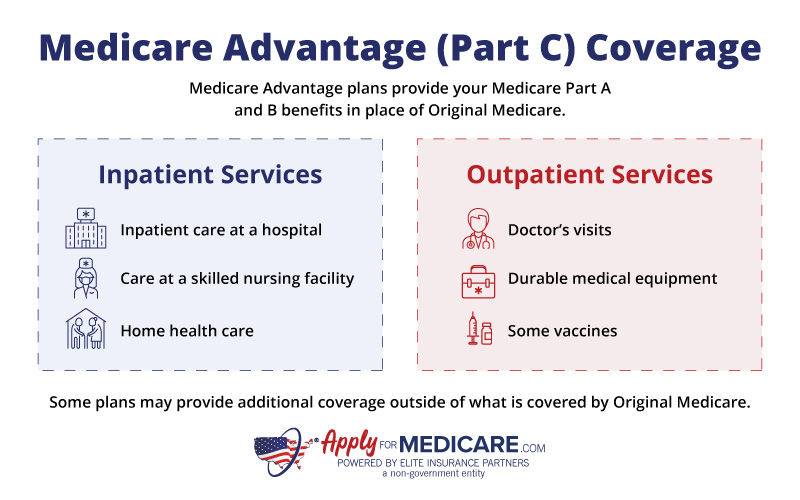

Medicare Part C, also known as a Medicare Advantage Plan, is a Medicare-approved private insurance plan offered by insurance companies to individuals enrolled in Medicare. Medicare Part C provides your Medicare Part A and Medicare Part B benefits in place of Original Medicare. Medicare Advantage plans may also provide coverage and benefits that aren’t covered by Original Medicare.

Though Medicare Advantage plans are required to give you at least the same coverage as Original Medicare, you may be required to use providers and facilities within the plan’s network. Rules, requirements, and costs for covered services will vary between Medicare Advantage plans. For example, a plan may require you to have a referral to receive care from a specialist for that service to be covered.

Part C Covers Medicare-Approved Inpatient Services

Medicare Part C covers inpatient services that are Medicare-approved. Since Medicare Advantage Plans (Part C) provide coverage for your Medicare Part A benefits, they must cover the same inpatient services that Medicare Part A covers. The inpatient services that Medicare Part C covers include:

- Inpatient care at a hospital

- Care at a skilled nursing facility

- Home health care

Part C Covers Medicare-Approved Preventative and Medically Necessary Services

Preventative care and outpatient services deemed medically necessary are typically covered by Medicare Part B. Therefore, when you enroll in Medicare Part C, those services will now be covered by your Medicare Advantage plan.

Outpatient and preventative services that Medicare Part C covers includes:

- Doctor’s visits

- Durable medical equipment

- Emergency ambulatory services

- COVID-19, Flu, Hepatitis B, and Pneumococcal vaccines

- Mammograms

- Diabetes screenings

(This is not a complete list; please contact your Medicare Advantage plan provider or review plan terms for a complete list of covered services).

For some Medicare Advantage plans, you will be required to choose a primary care doctor who can help coordinate your care and give referrals for specialist care. You may also need to acquire prior approval for certain services before they are covered.

Services That Aren’t Covered by Medicare Part C

Though Medicare Part C covers your Original Medicare benefits, there are some services that are covered by Original Medicare but are not covered by Medicare Part C.

Medicare Advantage plans do not pay for hospice care. Regardless of whether you’re enrolled in a Medicare Advantage plan, Original Medicare will pay for your hospice costs. You can keep your Medicare Advantage plan while receiving hospice care and use it for services that are not related to your terminal illness. Even though Original Medicare pays for your hospice care, you will need to continue to pay your Medicare Part C premium each month if you wish to remain enrolled in your Medicare Advantage plan.

Medicare Part C will not provide coverage for clinical trials/clinical research studies. If you participate in a clinical trial and have a Medicare Advantage plan, your Original Medicare may cover some costs. Your Medicare Part B benefit may cover a portion of some costs such as office visits and tests in certain qualifying clinical research studies.

Your Medicare Advantage Plan may not cover out of state services. Since most Medicare Advantage plans have networks, many plans will not pay for services outside of their network. Some plans may cover services outside of their network but at a higher cost. It is important to understand whether your plan restricts coverage a network, especially if you like to travel. However, all Medicare Advantage plans must provide coverage for emergency care anywhere in the U.S.

Do Medicare Advantage Plans Include Drug Coverage?

Some Medicare Advantage plans cover prescription drugs, and some do not. Medicare Advantage plans that include drug coverage are known as Medicare Advantage Prescription Drug Plans, or MAPD plans. When reviewing plans, check to see if drug coverage is included. If it is, the plan will have a drug formulary where you can review which drugs are covered.

Learn More About Medicare Advantage Prescription Drug Plans

Medicare Advantage Prescription Drug Plans, or MAPD plans, include drug coverage. Learn more about how drug coverage works with Medicare Part C.

There are a few important things you should be aware of when it comes to Medicare Part C and drug coverage:

- In most cases, if your plan does not offer drug overage, you cannot enroll in a stand-alone drug plan.

- Medicare Advantage Special Needs Plans must provide prescription drug coverage. These plans have special eligibility requirements and plan availability varies by location.

- Medicare Medical Savings Account plans do not cover prescription drugs; however, they are the only type of Medicare Advantage plan that allows you to enroll in a stand-alone Medicare Part D Prescription Drug plan.

Can Medicare Advantage Plans Deny Coverage?

Individuals with Medicare Advantage plans may need to acquire approval from their plan for certain services to be covered. In some cases, your Medicare Advantage plan may deny coverage for a service, leaving you to pay the full costs. Not all plans require pre-authorization, and some plans may only require it for very specific services. Ensure you take time to read through your plan’s terms and contact your plan representative if you have questions.

If your Medicare Advantage plan denies coverage for a service that your doctor deems medically necessary, you can appeal that decision. According to KFF.org, a majority of Medicare Advantage prior authorization requests that are initially denied are overturned when appealed.

To avoid the unwanted surprise of a denial of coverage, you can ask for an organization determination in advance. You or your provider can ask your Medicare Advantage plan provider in advance if a service will be covered and what your costs will be.

Each plan may have different rules such as deadlines when it comes to appealing coverage that was denied. This information can be found in your plan’s Evidence of Coverage. If you don’t have a Medicare Advantage plan yet, you can typically view a plan’s Evidence of Coverage on the provider’s website prior to applying.

Tips for Reviewing Medicare Advantage Plan Coverage

Since Medicare Advantage plans vary greatly between carriers and locations, it’s essential to review plans carefully before signing up. If you are interested in getting Medicare Part C, there are a few important things to keep in mind when reviewing and comparing plan coverage.

- Does the plan have the coverage you need? This may seem like a no-brainer, but sometimes we can get distracted by other benefits that a Medicare Advantage plan may offer. Keep your healthcare needs at the forefront when reviewing plan coverage and benefits. Look for Evidence of Coverage and Plan Summary documents to review coverages and costs.

- Does the plan include drug coverage, and if so, are your medications on the formulary? If a Medicare Advantage plan covers prescription drugs, it will have a formulary that lists out which drugs it covers. When looking for drug coverage, it is very important to review the formulary to ensure your medications are covered.

- Am I looking for additional coverage? Some individuals have healthcare needs that fall outside of Original Medicare’s coverage. If this sounds like you, you may consider a Medicare Advantage plan that offers additional benefits that fulfill those healthcare needs.

- If you’re feeling confused or have questions about the coverage offered by Medicare Part C, talk to a licensed insurance agent. We have a team of agents available to help you better understand Medicare Advantage plans and answer any questions you may have about coverage. You can speak with an insurance agent by calling the number above.

Sources

Understanding Medicare Advantage Plans Advantage Plans, Centers for Medicare & Medicaid Services. Accessed November 2023

https://www.medicare.gov/Pubs/pdf/12026-Understanding-Medicare-Advantage-Plans.pdf

Medicare & You 2024, Medicare.gov. Accessed November 2023

https://www.medicare.gov/publications/10050-Medicare-and-You.pdf