Summary: Though Original Medicare is the same across all 50 states, Medicare plans can vary greatly by state. Medicare Advantage plans, Medicare Part D plans, and Medicare Supplement plans have different availability and costs depending on where you live. Additionally, some states have unique enrollment rules for Medicare Supplement plans. In this article, we’ll review ways in which Medicare varies from state to state. Estimated Read Time: 6 min

Is Medicare Different in Each State?

Original Medicare, the portion of Medicare provided by the federal government, is the same in all 50 states, while Medicare plans, such as Medicare Advantage plans, will vary from state to state.

Original Medicare, which includes Medicare Part A and Part B, is offered by the federal government, which means benefits and costs are the same across all states. Someone in Florida who has Original Medicare will have the same Part A coverage and deductibles as someone in New York. Original Medicare premiums can vary based on your income, but not based on where you live.

Since Original Medicare benefits are the same regardless of where you live, you can use your Original Medicare coverage at any provider in the U.S. who accepts Medicare. So, if you live in Pennsylvania but are vacationing in California, you can use your Medicare coverage in California without worrying about networks.

Medicare plans, on the other hand, can vary greatly depending on your location. This includes Medicare Advantage plans, Medicare Part D Prescription Drug plans, and Medicare Supplement plans.

Medicare Plans Vary From State to State

During an insightful conversation about Medicare coverage, Joe Medina, a Senior Insurance agent provided this expert perspective, “Original Medicare, although the same across all 50 states, can be diversified when you add on additional coverages such as Medicare Part D, Medicare Advantage, or even Medicare Supplement plans.” He goes on to say, “Medicare Advantage and Part D are really the two most diverse plan types you can enroll in as coverage is different based on where you live.”

Since Medicare Advantage plans, Medicare Part D plans, and Medicare Supplement plans are offered by private insurance companies, availability and costs are dependent on the carrier. Even if two people in different states pick up the same plan offered by the same carrier, they could still have different costs.

Additionally, states can impose their own rules regarding Medicare plans, such as state-specific enrollment periods for Medigap plans.

Understanding how each plan differs from state to state is important, especially if you already have a Medicare plan and are going to be moving outside of your plan’s service area. Below, we’ll briefly explain how each type of Medicare plan varies from state to state.

How Medicare Advantage Plans Vary by State

Medicare Advantage Plans not only vary from state to state but can even vary from county to county. For Medicare Advantage plans, the following will vary based on where you live:

- Carrier and plan availability

- Plan coverage and benefits

- Plan costs including premiums, deductibles, MOOP, etc.

- Plan networks

How Medicare Part D Plans Vary by State

Like Medicare Advantage plans, Medicare Part D Prescription Drug plans vary between states and even counties. Depending on where you live, Medicare Part D plans can vary in the following ways:

- Plan and carrier availability

- Plan premiums, deductibles, and copays

- Plan formularies and networks

How Medicare Supplement Plans Vary by State

Medicare Supplement Plan benefits are standardized by the federal government, so every lettered plan must offer the same benefits regardless of carrier or location. However, Medicare Supplement plans do vary from state to state in other ways:

- Though benefits are standardized, costs can vary

- Massachusetts, Minnesota, and Wisconsin have unique Medicare Supplement plans

- Medicare Supplement enrollment periods/rules can vary by state

- Some states have plans available for enrollees under age 65, others do not

State-Specific Rules About Medicare Supplement Plans

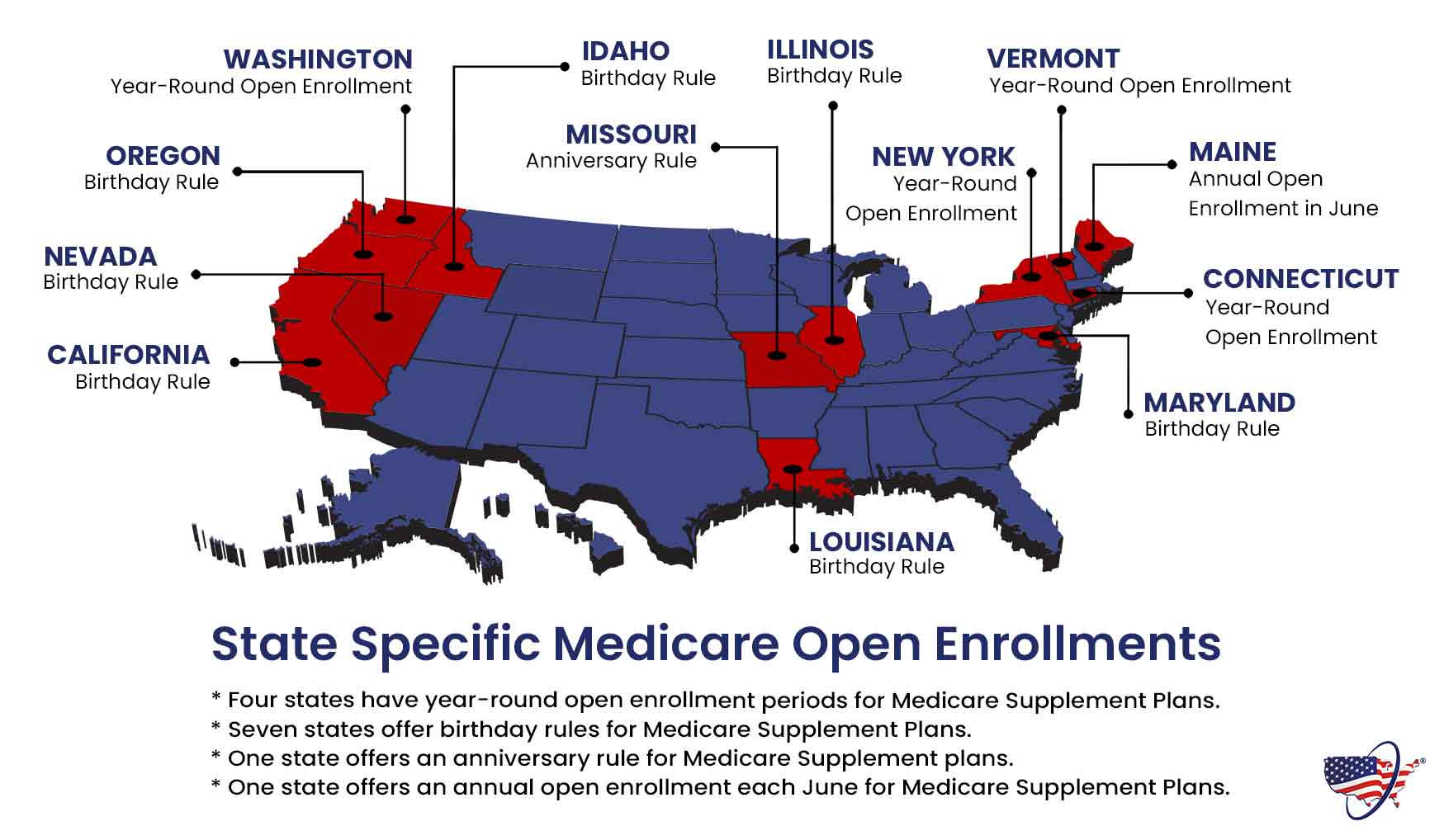

There are a number of state-specific rules regarding Medicare Supplement plan enrollment. Roughly 58% of Medicare beneficiaries live within a state with state-specific rules for Medigap plans. If you have or are interested in enrolling in a Medicare Supplement plan, you’ll want to take note if your state is listed below.

State Birthday Rules for Medicare Supplement Plans

State birthday rules are a unique opportunity for Medicare Supplement plan holders to change plans with no underwriting health questions and no risk of denial. Only select states have birthday rules, and each state has its own regulations regarding enrollment.

“Medicare Supplement birthday rules are a great way for individuals to make changes to their Medigap coverage without having to go through medical underwriting” Ashlee Zareczny, our Medicare educator explains. “Often, seniors with more serious health conditions are unable to qualify for a new Medigap plan after their Initial Open Enrollment Period has closed. This (a birthday rule) allows them the opportunity to make an annual change that best fits their lifestyle.”

| State | Duration | Changes You Can Make |

|---|---|---|

| California | 91-day period, beginning 30 days before your birthday | Enroll in a plan of equal or lesser benefits through any carrier |

| Idaho | 63-day period, beginning on your birthday | Enroll in a plan of equal or lesser benefits through current carrier |

| Illinois | 45-day period, beginning on your birthday | Enroll in plan of equal or lessor benefits through current carrier |

| Louisiana | 93-day period, beginning 30 days before your birthday | Enroll in a plan of equal or lessor benefits through current carrier |

| Maryland | 31-day period, beginning on your birthday | Enroll in a plan of equal or lessor benefits through any carrier |

| Nevada | 61-day period, beginning on the first day of your birth month | Enroll in a plan of equal or lessor benefits through any carrier |

| Oklahoma | 60-day period, beginning on your birthday | Enroll in a plan of equal or lessor benefits through any carrier |

| Oregon | 31-day period, beginning on your birthday | Enroll in a plan of equal or lessor benefits through any carrier |

States with Annual Guaranteed Issue Rights for Medigap Plans

There are two states that have annual guaranteed issue rights. This means Medicare Supplement policy holders in these states can change plans annually without undergoing medical underwriting. Both states have specific rules regarding the annual guaranteed issue rights period:

- Missouri – Each year, you can make a change to your Medicare Supplement plan up to 30 days before your policy anniversary and up to 30 days after your policy anniversary. During this time, you can enroll in a Medicare Supplement plan of equal or lesser benefits through the carrier of your choice.

- Maine – All Medicare Supplement carriers must designate one month each year to guarantee acceptance to applicants for at least Medicare Supplement Plan A. The designated month in Maine is June, however, carriers may choose to extend this period.

States with Year-Round Enrollment Without Medical Underwriting

Four states allow you to enroll in a Medicare Supplement plan at any time throughout the year without answering questions about your health (also called medical underwriting). If you live in one of the following states, you can enroll in and change Medicare Supplement plans at any time for any reason, regardless of your health:

- Connecticut

- New York

- Vermont (UnitedHealthcare® and Mutual of Omaha only)

- Washington

Which States Require Medicare Supplement Plans for Those Under 65?

The federal government does not require Medicare Supplement plan carriers to offer plans to individuals who qualify for Medicare under the age of 65. However, some states require any carriers offering Medicare Supplement plans to offer at least one option to people under 65.

States that require Medicare Supplement plan carriers to provide at least one plan to those under 65 include:

- Alabama

- Arkansas

- Arizona

- Idaho

- Indiana

- Iowa

- Nebraska

- Nevada

- New Mexico

- North Dakota

- Ohio

- Rhode Island

- South Carolina

- Utah

- Virginia

- Washington

- West Virginia

- Wyoming

Why It’s Important to Understand How Medicare Differs in Each State

Understanding Medicare can be challenging, and state-specific Medicare rules only make things more complicated. Still, it is important to familiarize yourself with any state-specific rules that apply to the state you live in. If you are planning to move to another state, you will also want to familiarize yourself with any state-specific rules that the state you’re moving to has.

It is also important to understand that if you have a Medicare Advantage plan or a Medicare Part D plan and move out of your plan’s service area, you may not be able to get a plan with the exact same coverage, benefits, or costs; it will depend on what’s available in the area you’re moving to.

If you have further questions regarding state-specific Medicare rules, and would like to speak to a licensed agent, you can do so by calling the number above.

Sources

Get Medigap Basics, Medicare.gov. Accessed February 2024

https://www.medicare.gov/health-drug-plans/medigap/basics

Medicare Supplement Insurance “Medigap”, California Department of Insurance. Accessed February 2024

https://www.insurance.ca.gov/0150-seniors/0100alerts/SA-01-10B.cfm