Summary: Medicare Advantage Prescription Drug Plans provide your Original Medicare benefits while also providing coverage for prescription drugs. Below, we’ll explain how MAPD plans work, who can enroll, and how you can ensure you get the drug coverage you need. Estimated Read Time: 5 min

What is a Medicare Advantage Prescription Drug Plan?

When choosing prescription drug coverage, Medicare enrollees typically have two options: enroll in a standalone Medicare Part D Prescription Drug Plan (PDP) or enroll in a Medicare Advantage Prescription Drug plan (MAPD). Over the past few years, MAPD plans have grown in popularity among Medicare beneficiaries. For many, these plans help simplify healthcare coverage by rolling inpatient, outpatient, and drug coverage all into one plan.

Medicare Advantage Prescription Drug Plans, also referred to as MAPD plans, are Medicare Advantage plans that include Medicare Part D drug coverage. These plans are offered by private insurance companies to individuals who are enrolled in Medicare. Medicare Advantage drug plans provide your Original Medicare benefits in addition to helping pay for prescriptions.

MAPD Plan Eligibility

MAPD plans share the same eligibility requirements as other Medicare Advantage plans. To be eligible for a MAPD plan, you must meet the following requirements:

- You must have Medicare Part A and Medicare Part B

- You must be a U.S. citizen

- You must live in an area where the plan is available

For those who already have a Medicare Advantage plan, you can switch to a MAPD plan during the Medicare Advantage Open Enrollment Period. During this period, you may also choose to drop your MAPD plan if you wish to return to Original Medicare.

Which Medicare Advantage Plans Offer Drug Coverage?

There are many types of Medicare Advantage plans that offer prescription drug coverage. Apart from Special Needs plans, Medicare Advantage plans are not required to offer drug coverage. It is important to review individual plan information carefully to ensure the plan is offering the coverage you need.

The most common MAPD plans are Health Maintenance Organizations (HMO) plans and Preferred Provider Organization (PPO) plans. These Medicare Advantage plans are the most likely to offer prescription drug coverage.

Private Fee-for-Service (PFFS) plans may offer drug coverage, though it is less common. If your PFFS plan does not provide drug coverage, you can join a standalone drug plan.

Medicare Savings Account (MSA) plans do not offer drug coverage. Unlike most other Medicare Advantage plans, if you have a MSA plan you can enroll in a standalone prescription drug plan.

Medicare Advantage Special Needs Plans (SNPs) must include drug coverage but are limited to individuals who meet specific requirements.

Whether or not a type of MAPD plan is available to you will depend on your location. Though Medicare Advantage plans are becoming increasingly available across the U.S., there are still areas where plan availability is limited.

What Do MAPD Plans Cover?

MAPD plans provide Medicare Part A hospital coverage, your Medicare Part B medical coverage, and Medicare Part D prescription drug coverage. Some plans may offer additional coverage for items and services not typically covered by Original Medicare.

To determine which drugs are covered under a MAPD plan, you will want to review the plan’s formulary. The formulary will list out all drugs that are covered under the Medicare Advantage Prescription Drug plan as well as which tier each drug is in.

In addition to reviewing the formulary, you should check which pharmacies are within your plan’s network. Since most Medicare Advantage plans have networks, you’ll want to ensure you have access to an in-network pharmacy. Some MAPD plans may allow you to go outside of your plan’s network, but you will typically pay higher costs.

Coverage for Medicare Advantage Prescription Drug plans can change annually. Each year in the fall, your MAPD plan provider will send you an Annual Notice of Change. This notice will include any changes to your plan’s formulary that will go into effect in the upcoming year. It will also include any changes to costs, benefits, or other significant changes to your plan. It’s essential to review this notice each year to make sure any prescriptions you take will continue to be covered into the next year.

MAPD vs PDP: Understanding the Differences

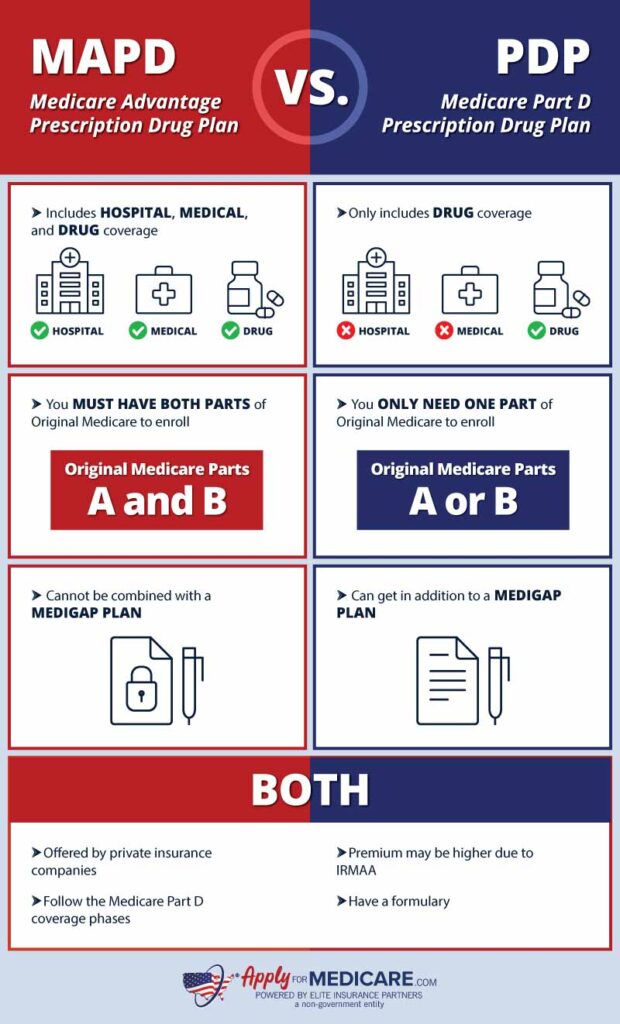

When you’re comparing options for drug coverage, you may notice that there are “MAPD” plans and “PDP” plans. Though these plans sound similar, it’s important to understand the differences between them.

MAPD plans cover your Original Medicare benefits, prescription drugs, and may include additional coverage. Standalone Medicare Part D Prescription Drug plans, or PDPs, only cover prescription drugs; because of this, you can enroll in a PDP alongside Original Medicare.

To enroll in a Medicare Advantage Prescription Drug plan, you must have both parts of Original Medicare: Medicare Part A and Medicare Part B. However, if you would like to enroll in a standalone Medicare Part D plan, you are only required to have one part of Original Medicare.

Costs, including premiums, deductibles, and copayments will all vary between plans, carriers, and locations. Whether you are enrolled in a MAPD plan or a PDP, you may end up paying a higher premium due to your income. This is known as the Medicare Part D IRMAA.

Both MAPD and PDP plans will follow the Medicare Part D coverage phases: annual deductible, initial coverage, coverage gap, and catastrophic coverage. Note that these phases will see major changes in 2024 and 2025 due to the Inflation Reduction Act. Visit our Medicare Part D page for more information.

How to Get Help With Medicare Advantage Drug Coverage

Having drug coverage is important for keeping the out-of-pocket costs of your medications manageable. Additionally, choosing not to enroll in drug coverage without creditable coverage can result in a late enrollment penalty when you enroll later.

If you have questions regarding Medicare drug coverage and were not able to find your answers here, give us a call. We have a team of licensed insurance agents that can help answer questions you may have regarding MAPDs and PDPs.

Sources

How Medicare Prescription Drug Coverage Works with a Medicare Advantage Plan or Medicare Cost Plan, CMS. Accessed November 2023

https://www.medicare.gov/Pubs/pdf/11135-prescription-drug-coverage-with-ma-mcp.pdf

Understanding Medicare Advantage Plans Advantage Plans, Medicare. Accessed November 2023

https://www.medicare.gov/Pubs/pdf/12026-Understanding-Medicare-Advantage-Plans.pdf

An Overview of the Medicare Part D Prescription Drug Benefit, KFF. Accessed November 2023