Summary: The Medicare General Enrollment period runs annually from January 1st to March 31st. During this time, you can enroll in Medicare Part A and Medicare Part B if you didn’t do so during your Initial Enrollment Period. If you enroll during the Medicare GEP, you may face late enrollment penalties. Learn more about the General Enrollment Period below. Estimated Read Time: 4 min

What Is The General Enrollment Period for Medicare?

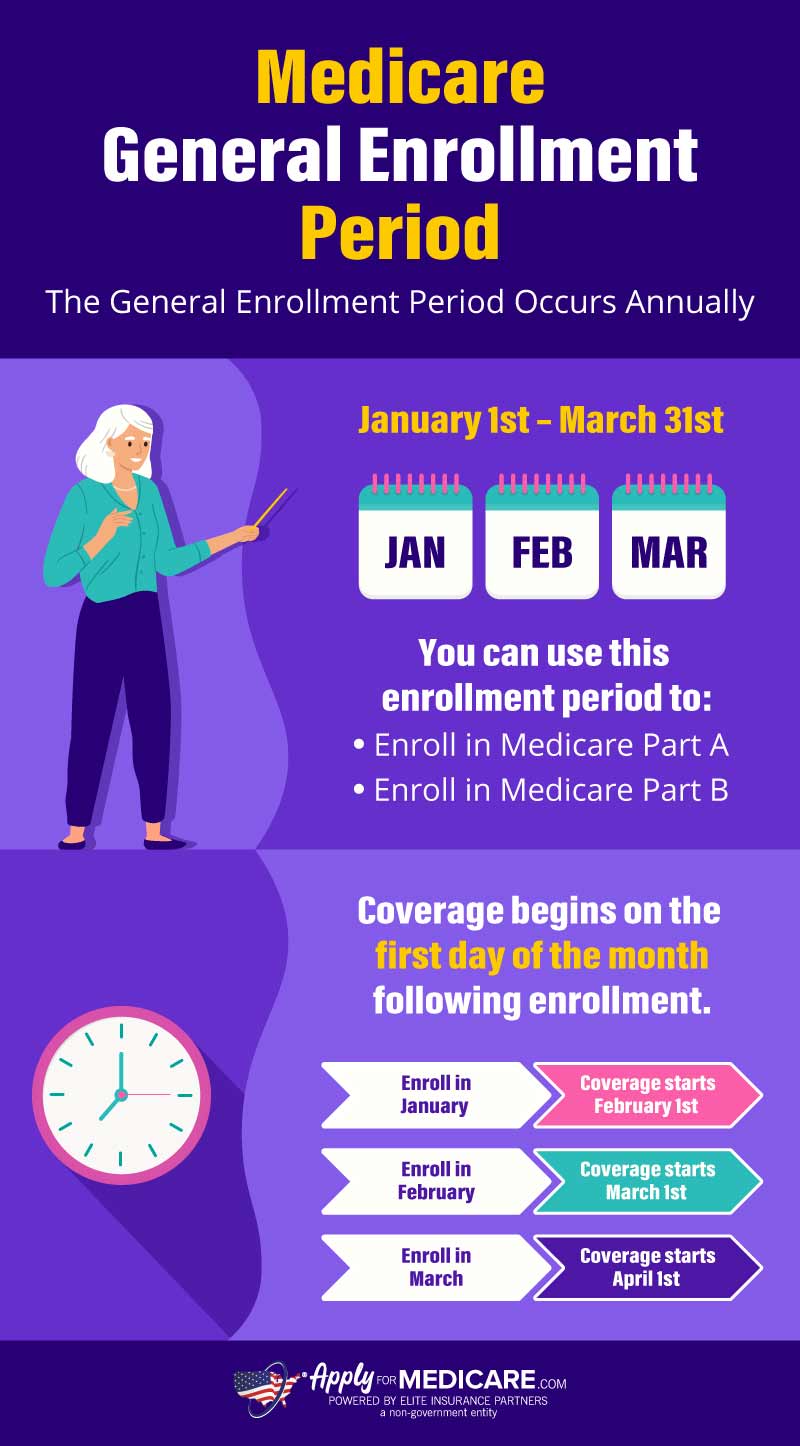

The Medicare General Enrollment Period is an annual enrollment window from January 1st through March 31st in which you can enroll in Original Medicare (Part A and Part B). This enrollment period is for individuals who:

- Did not sign up for Medicare Part B and/or Medicare Part A during their Initial Enrollment Period

AND

- Did not qualify for a Special Enrollment Period

During the General Enrollment Period, you will need to manually sign up for Medicare coverage through the Social Security Administration. This can be done online, in person, or over the phone. If you are enrolling in Original Medicare during the General Enrollment Period, you may be subject to paying late enrollment penalties for Medicare Part A and/or Medicare Part B.

When Does Coverage Start if You Enroll During the General Enrollment Period?

If you enroll in Medicare Part A and/or Medicare Part B during the General Enrollment Period, your coverage will start on the first day of the following month.

| Month You Enroll in Coverage | Coverage Start Date |

|---|---|

| January | February 1st |

| February | March 1st |

| March | April 1st |

The coverage start date when enrolling during the General Enrollment Period was changed in 2023. Prior to 2023, if you had enrolled in Medicare coverage during the Medicare GEP, you would have had to wait until July 1st for your coverage to begin.

When you enroll in Medicare Part A and/or Medicare Part B during the General Enrollment Period, you will receive a Special Enrollment Period to sign up for a Medicare Part D Prescription Drug Plan. This period begins the date you submit your application during the GEP and lasts for two months.

How the GEP Works With Medicare Savings Programs

One of the reasons an individual may choose to decline Medicare coverage during their Initial Enrollment Period is due to the monthly premiums of Medicare Part B (and Part A if they need to buy it). For some, these premiums may be unaffordable. Medicare Savings Programs are available to low-income individuals who need help with paying their Original Medicare premiums, deductibles, and other costs.

If you need to pay a monthly premium for Medicare Part A, the Qualified Medicare Beneficiary (QMB) Program can help with those costs. When you apply for Medicare Part A, you can ask your Social Security Administration representative for a “conditional enrollment”. Conditional enrollment means you will only be enrolled in Part A if you are approved for the QMB program.

In many states, you can use the conditional enrollment process at any time during the year. However, for the below 14 states, you will need to use conditional enrollment during the annual General Enrollment Period.

Those states are Alabama, Arizona, California, Colorado, Illinois, Kansas, Kentucky, Missouri, Nebraska, New Jersey, New Mexico, South Carolina, Utah, and Virginia.

What Happens if I Miss the General Enrollment Period?

Generally, if you do not sign up for Medicare Part B (or buy Medicare Part A) during the General Enrollment Period, you will need to wait a year until the next General Enrollment Period begins to enroll in coverage. You may be able to enroll in coverage earlier if you missed the General Enrollment Period due to circumstances outside of your control and are eligible for a Special Enrollment Period.

If you are not eligible for a Special Enrollment Period, you will likely be responsible for paying a late enrollment penalty for Medicare Part B and Medicare Part A. This penalty increases the longer you go without coverage, which is why it is important to sign up as soon as possible. Here’s an example of how missing your General Enrollment Period can impact your penalty:

Steve first became eligible for Medicare Part B in May of 2022, but did not sign up for coverage. He didn’t have any other health coverage during this time. His next chance to sign up for Part B was during the 2023 General Enrollment Period from January 1st to March 31st. If he had signed up for coverage during this time, he would not have had to pay a Medicare Part B late enrollment penalty because you only incur a penalty if you go a full 12 months (one year) without coverage.

However, Steve forgot to sign up for Medicare Part B during the 2023 GEP. So, he had to wait until the 2024 General Enrollment Period to get Medicare Part B coverage. Since an entire year had elapsed since he first became eligible, Steve will now need to pay an extra 10% penalty on top of his Medicare Part B premium each month.

If you have questions about the General Enrollment Period, or are unsure when you should enroll in coverage, you can contact Medicare directly, or call the number above to speak with a licensed insurance agent. Check out our resources below to learn more about Medicare enrollment periods and how to sign up for coverage.

Medicare Initial Enrollment Period

The General Enrollment Period is the only time outside of your Initial Enrollment Period that you can sign up for Medicare Part B (and premium Part A). For many, it’s ideal to sign up during your IEP.

How to Apply for Medicare Online

During the General Enrollment Period, you can apply for Medicare online from the comfort of your home. Learn more about the process of applying online here.

Medicare Late Enrollment Penalties

If you sign up for Medicare Part A and Medicare Part B during the General Enrollment Period, you may need to pay late enrollment penalties.

Sources

Medicare & You 2024 The Official U.S. Government Medicare Handbook, Medicare.gov. Accessed January 2024

https://www.medicare.gov/publications/10050-Medicare-and-You.pdf

When is the Medicare General Enrollment Period? National Council on Aging. Accessed January 2024

https://www.ncoa.org/article/a-closer-look-at-the-medicare-general-enrollment-period

Original Medicare (Part A and B) Eligibility and Enrollment. Centers for Medicare & Medicaid Services. Accessed January 2024

https://www.cms.gov/medicare/enrollment-renewal/health-plans/original-part-a-b