Summary: Medicare Special Enrollment Periods allow you to make changes to your Medicare coverage outside of normal enrollment windows. You must have a qualifying event to be eligible for a Special Enrollment Period such as losing your employer coverage, moving to a different state, or being impacted by a natural disaster. In this article, we’ll take a detailed look at the different types of Special Enrollment Periods and how to qualify. Estimated Read Time: 4 min

What are Medicare Special Enrollment Periods?

Medicare Special Enrollment Periods allow you to enroll in or make changes to your Medicare coverage outside of typical Medicare enrollment periods. To receive a Special Enrollment Period, you must experience a qualifying event. Qualifying events are defined by Medicare and the Social Security Administration.

Each Special Enrollment Period has different requirements and has different rules regarding which changes you can make and the timeframe in which you must make those changes. Just like any other Medicare enrollment period, it’s important to understand how Special Enrollment Periods work so you can ensure you have the coverage you need, when you need it.

Medicare Part A and Medicare Part B Special Enrollment Period

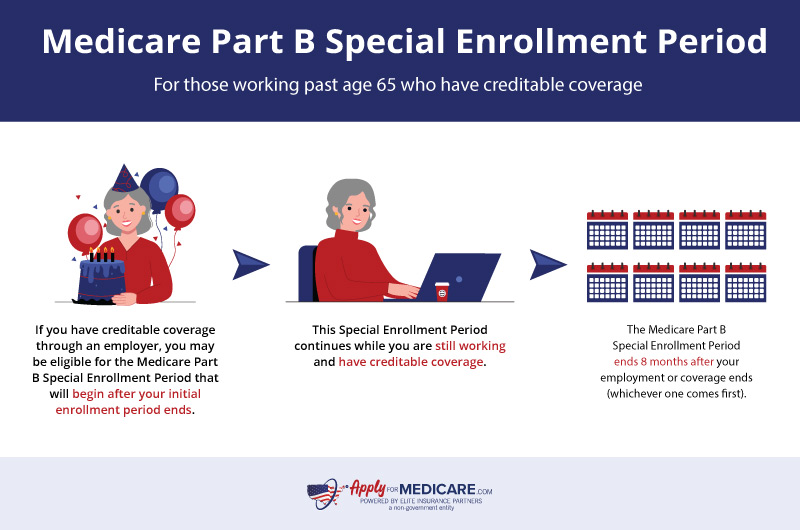

You will qualify for a Medicare Part B Special Enrollment Period if you delayed enrolling in Part B because you are working past 65 and have creditable health coverage. You will also qualify for the Medicare Part B SEP (Special Enrollment Period) if you have coverage through your spouse’s job-based group, or union insurance.

The duration in which you have health insurance through an employer will determine how long your Special Enrollment Period is:

- The Medicare Part B Special Enrollment Period begins after your Initial Enrollment Period ends if you have creditable coverage.

- The Medicare Part B Special Enrollment Period ends 8 months after your employment or coverage ends (whichever comes first).

You can sign up for Medicare Part B coverage at any time while you have coverage from an employer. However, once your coverage ends, you’ll have eight months to sign up for Medicare Part B without incurring a late enrollment penalty. If you miss your Special Enrollment Period, you may face a penalty that will be added to your Medicare Part B premium each month.

During this Special Enrollment Period, you can also enroll in Medicare Part A. Though less common, some individuals do not qualify for a $0 premium for Medicare Part A and will therefore delay enrollment because they have other creditable coverage. While you have coverage, or during the 8 months following the end of your coverage, you can buy Medicare Part A. Failing to enroll in Medicare Part A during the Special Enrollment Period (if you must buy Part A) can result in a late enrollment penalty.

Important note: the Medicare Part A and Medicare Part B Special Enrollment Period is based on current employer coverage. This means you will not qualify for this Special Enrollment Period if you have COBRA coverage, a retiree health plan, VA coverage, or individual health insurance coverage (such as coverage through the Health Insurance Marketplace).

Special Enrollment Periods for Exceptional Circumstances

Effective January 1st, 2023, Medicare-eligible individuals can receive a Special Enrollment Period if they miss enrolling in Original Medicare due to certain exceptional circumstances. During an exceptional circumstances Special Enrollment Period, you can enroll in Medicare Part B (and premium Part A) without incurring a late enrollment penalty.

Exceptional Circumstances Special Enrollment Period Chart:

| Exceptional Circumstances | Duration of Special Enrollment Period |

|---|---|

| Impacted by a natural disaster or emergency (declaration must be on or after 1/1/23) | Begins at the start of the emergency or disaster and ends 6 months after the emergency or disaster has ended. |

| Incarceration – you were released from incarceration on or after 1/1/23 | Begins the day you are released from incarceration and ends on the last day of the 12th month after you were released. |

| Employer or health plan misinformation – you didn’t enroll in Part B during your IEP, GEP, or other SEP due to misinformation from your employer, health plan, or broker (on or after 1/1/23). | Begins the day you notify Social Security about the misrepresentation and ends 6 months after. |

| Losing Medicaid coverage – you lost Medicaid coverage on or after 1/1/23. | Begins when you are notified of the loss of Medicaid coverage and ends 6 months after your Medicaid coverage ends. |

If you missed your enrollment due to circumstances outside of your control that are not on the list above, you can contact Social Security to see if your situation qualifies you for a SEP. When enrolling in Medicare during the exceptional circumstances SEP, you must submit form CMS-10797 to the Social Security Administration.

As of January 1st, 2024, if you enroll in Medicare Part B and/or Medicare Part A during a Special Enrollment Period due to an exceptional circumstance, you will have two months to sign up for a Medicare Advantage Plan or Medicare Part D Prescription Drug Plan.

Medicare Advantage and Medicare Part D Special Enrollment Periods

Special Enrollment Periods for Medicare Advantage plans and Medicare Part D plans occur when certain events happen in your life. Generally, when you qualify for a Medicare Advantage or Medicare Part D SEP, you will have a two-month period to make changes to your coverage. However, depending on your qualifying event, your Special Enrollment Period may be longer or shorter.

Some common qualifying events for Medicare Advantage and Medicare Part D SEPs include moving, losing your coverage, and qualifying for programs such as Medicaid or Extra Help. Each qualifying event will have different rules regarding what changes you can make to your coverage and how long your SEP will last. In the chart below, you’ll find a brief overview of some events that would give you a Special Enrollment Period.

| Qualifying Event | Changes You Can Make | Duration of the SEP |

|---|---|---|

| Moving outside of your plan’s service area | Switch to a new Medicare Advantage plan or Medicare Part D plan. You can also choose to return to Original Medicare. | If you inform your plan before moving: the month before you move and 2 full months after you move. |

| Moving back to the U.S. after living outside of the country | Join a Medicare Part D drug plan or a Medicare Advantage plan. | Two full months after the month you move back to the U.S. |

| Released from jail | Join a Medicare Part D drug plan or a Medicare Advantage plan. | Two full months after you’re released from jail. *You have to sign up for Original Medicare before you can join a plan* |

| You lose coverage from an employer or union (includes COBRA) | Join a Medicare Part D drug plan or a Medicare Advantage plan. | Two full months after your coverage ends. |

| Medicare terminates my plan’s contract | Switch to a new Medicare Advantage plan or Medicare Part D plan. | Begins two months before the contract ends and ends 1 full month after. |

| I had a Special Needs Plan but no longer meet the qualifications for that plan | Switch from a Special Needs Plan to a Medicare Advantage Plan. | Begins when you lose your special needs status and lasts up to 3 months after your SNP’s grace period ends. |

There are several specific qualifying events that would allow you to make changes to your Medicare Part C (Medicare Advantage) or Medicare Part D plans. If you’re unsure if a life event meets the qualifications for a Special Enrollment Period, you can learn more by visiting Medicare.gov or calling Medicare directly at 1-800-633-4227.

5-Star Special Enrollment Period for Medicare Health Plans

Medicare Advantage plans, Medicare Part D Prescription Drug plans, and Medicare Cost plans are all given performance star ratings by Medicare. This rating is based on information from plans, health care providers, and member satisfaction surveys. These ratings are updated in the fall and can be found by using the Medicare.gov plan finder tool.

If you are dissatisfied with your current Medicare health plan, you can use the 5-Star Special Enrollment Period to drop your current plan and switch to a plan with a 5-star quality rating that is available in your area. This Special Enrollment Period can be used between December 8th and November 30th and can only be used once.

Trial Right Special Enrollment Periods for Medicare Supplement Plans

Medicare also offers two trial rights that allow you to use a Special Enrollment Period to enroll in a Medigap plan if you are not happy with the Medicare Advantage plan you originally chose. When you qualify for a Special Enrollment Period due to a trial right, you will have guaranteed issue rights; this means you won’t have to undergo medical underwriting when you join a Medigap plan.

If you joined a Medicare Advantage Plan when you first became eligible for Medicare and decided within the first year of joining that you wanted to switch back to Original Medicare, you will get a Special Enrollment Period. During this trail right Special Enrollment Period, you can join any Medicare Supplement plan that’s available in your state. Your trial right SEP begins 60 days before your coverage ends and ends no more than 63 days after your coverage ends.

If you dropped a Medicare Supplement Plan to join a Medicare Advantage Plan for the first time and decided you want to switch back, you can qualify for a trial right Special Enrollment Period. You must have had your Medicare Advantage plan for less than a year to qualify for this trial period. During this SEP, you will be able to drop your Medicare Advantage plan and return to the Medicare Supplement plan that you previously had. If that policy is no longer available, you can enroll in a different Medigap plan that’s available in your state.

FEMA Special Enrollment Periods for Medicare

Sometimes emergencies and disasters can interfere with Medicare enrollment. A Special Election Period (Special Enrollment Period) is available for individuals who are unable to make changes to their coverage due to an emergency or disaster.

To qualify for a Special Enrollment Period due to a declared emergency or disaster you must meet the following requirements:

- You must reside (or resided at the start of the SEP eligibility period) in an area where a federal, state, or local government entity has declared a disaster or emergency.

- You were eligible for another enrollment period at the time of eligibility for this SEP.

- You did not make a coverage election during that enrollment period due to the disaster or emergency.

Let’s look at an example: Susan was planning on enrolling in Original Medicare during the General Enrollment Period. Unfortunately, Susan was displaced from her home during a declared natural disaster and was unable to enroll in coverage before the General Enrollment Period ended on March 31st. Susan will qualify for a Special Enrollment Period in which she can enroll in Original Medicare.

The Special Enrollment Period for those affected by an emergency or disaster will last the full duration of the emergency or disaster plus an additional two months after the emergency/disaster ends.

You can find current declared disasters and emergencies by visiting the Federal Emergency Management Agency (FEMA) website.

Why Understanding Special Enrollment Periods is Important

Understanding Special Enrollment Periods and how they work is important for a number of reasons.

- Enrolling in coverage during a SEP can help you avoid late enrollment penalties.

- Special Enrollment Periods can help ensure you don’t have a lapse in healthcare coverage.

- If you’re unhappy with your coverage, a Special Enrollment Period can give you the opportunity to change plans.

- Special Enrollment Periods help ensure you don’t miss out on coverage due to circumstances outside of your control.

Since Special Enrollment Periods have specific rules and conditions, it’s easy to forget that they exist. If you’re unsure whether qualify for a Special Enrollment Period, just ask. You can contact Medicare directly, or if you’d like to speak with a licensed insurance agent, you can do so by calling the number above.

Sources

Medicare and You 2024 the Official U.S. Government Medicare Handbook, Medicare.gov. Accessed January 2024

https://www.medicare.gov/publications/10050-Medicare-and-You.pdf

Special Election Issues for Individuals Affected by Declared Emergencies and Disasters, CMS.gov. Accessed January 2024