Summary: Medicare Part B provides medical insurance coverage for those enrolled in Original Medicare. This coverage includes doctor’s visits, outpatient services, durable medical equipment, and more. Learn essential information about Medicare Part B including covered services, eligibility, and out-of-pocket costs. Estimated Read Time: 6 min

What is Medicare Part B?

Medicare Part B is the part of Original Medicare that covers doctor visits and outpatient services. Under Medicare Part B you receive medical insurance that provides basic coverage for preventive and medically necessary outpatient services.

Part B Medicare Coverage Includes:

- Doctors visits

- Outpatient care

- Ambulance services

- Lab work and x-rays

- Physical and occupational therapy

- Preventive services (screenings, vaccines, annual “wellness” visits)

- Durable medical equipment (wheelchairs, walkers, and other equipment)

- Some vaccines

- And more

What is Not Covered by Medicare Part B?

- Dental care

- Vision

- Hearing

- Cosmetic surgeries

- Prescription drugs

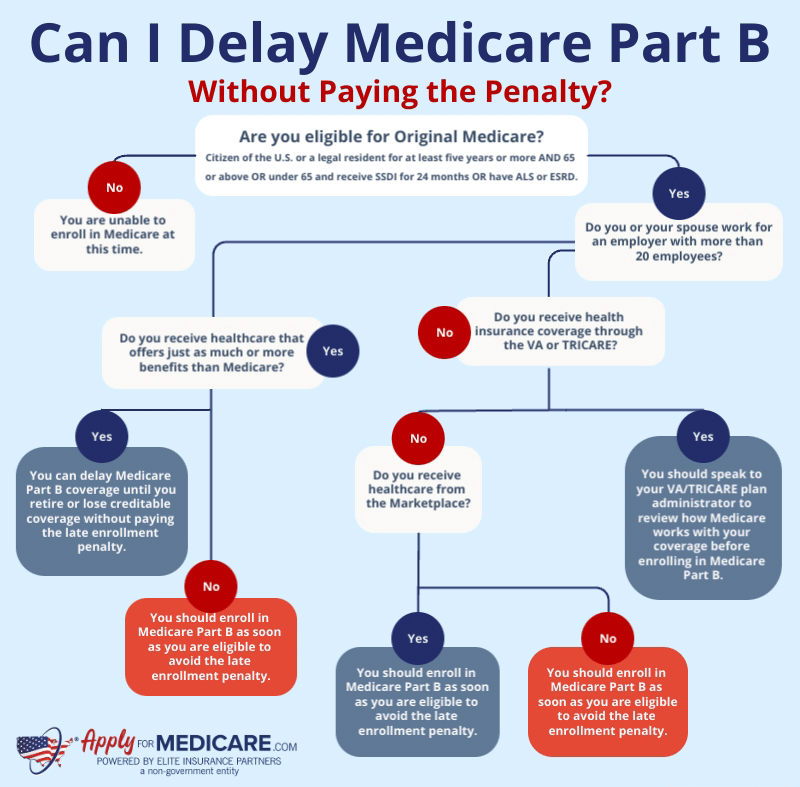

Most U.S. residents become eligible for Medicare Part B once they turn 65. However, you may become eligible before age 65 if you receive Social Security disability. If you don’t sign up for Medicare Part B when you first become eligible, and do not have creditable coverage, you could face a late enrollment penalty. Thus, it is essential to enroll in coverage as soon as possible to avoid any additional costs in the future.

Like Medicare Part A, you can use your Part B benefits at any health care provider nationwide that accepts Original Medicare. Thus, this coverage is great for someone who intends on traveling throughout their retirement and doesn’t want to worry about strict networks when needing necessary care.

Medicare Part A vs. Medicare Part B

Medicare Part A and Medicare Part B are the two parts of Medicare that make up Original Medicare. Medicare Part A handles inpatient care and services, while Medicare Part B handles outpatient care such as doctor visits.

It can sometimes be confusing to differentiate inpatient from outpatient care. For example, a visit to the emergency room is considered outpatient care and would be billed to your Medicare Part B. However, if you are admitted, our care onward is considered inpatient and would be billed to your Medicare Part A. Medicare Part A and Medicare Part B also differ in costs. For most individuals, you will not have to pay a premium for Medicare Part A. However, you will need to pay a monthly premium for Medicare Part B. Both Medicare Part A and Part B have out-of-pocket costs including deductibles, coinsurance, and copayments.

Medicare Part B Costs

When enrolled in Medicare Part B, you will be responsible for paying a monthly premium, annual deductible, coinsurance, and copayments when you receive care. Unlike Part A, there is no premium-free option for Medicare Part B.

The Medicare Part B standard premium changes annually and those in a higher income bracket will pay a higher monthly premium. This is known as Income-Related Monthly Adjustment Amount or IRMAA . This additional premium will be added to your monthly premium if you qualify based on your tax returns from two years prior to the current year.

Where Medicare Part A has a per-occurrence deductible, the Part B deductible is per calendar year. This means you’ll only have to pay the deductible once each year regardless of how often you use your coverage.

In addition to your deductible, Medicare Part B coinsurance is typically 20% of the cost for each Medicare-covered service. For example, if your medical service cost is $100, you would be responsible for paying $20 and the rest would be paid by Medicare.

Medicare Part B Cost Summary

| Part B Costs | 2025 Amount | 2024 Amount |

|---|---|---|

| Monthly Premium | $185.00 (or higher depending on income) | $174.70 (or higher depending on income) |

| Annual Deductible | $257 | $240 |

| Coinsurance | 20% of cost for each Medicare-covered service (see above for more information) | 20% of cost for each Medicare-covered service (see above for more information) |

*You will want to make sure your healthcare provider accepts Medicare assignment, otherwise you could end up having to pay excess charges.

Just like Part A, there is no annual limit on what you pay out-of-pocket for Medicare Part B services. If you’re concerned that your Part B coinsurance costs will put a strain on your budget, you may consider additional coverage options like a Medicare Supplement plan or a Medicare Advantage plan.

When Can I Enroll in Medicare Part B?

Most people apply for Medicare Part B alongside Medicare Part A once they first become eligible. This is known as the Initial Enrollment Period, which for most people is when they turn 65. The Initial Enrollment Period lasts for seven months, starting three months before you turn 65 and ending three months after you turn 65.

If you sign up for Original Medicare during the three months prior to your birthday, your benefits will begin on the first day of your birthday month. If you enroll during your birthday month or the three months following your birthday, your coverage will begin on the first of the following month.

You may choose to postpone enrolling in Medicare Part B past your Initial Enrollment Period. If you’re still receiving credible coverage, such as insurance through your employer, you will be granted a Special Enrollment Period for getting your Medicare Part B later.

If you missed your Initial Enrollment Period and do not qualify for a Special Enrollment Period, you can still enroll in Medicare Part B during the General Enrollment Period. Because you are enrolling outside of your Initial Enrollment Period, you may have to pay a monthly late enrollment penalty.

When you become eligible for Medicare, you can apply for Medicare Part B online. You can also enroll in Medicare Part B over the phone or by visiting your local Social Security office.

Is Medicare Part B Mandatory?

It is not mandatory to enroll in Medicare Part B. In fact, it isn’t mandatory to enroll in any Part of Medicare. However, since most people qualify for premium-free Part A, most people enroll as soon they become eligible. If you choose to delay Medicare Part B coverage as soon as you are eligible, you could face penalties if you decide to enroll later.

There are a few reasons why someone may choose not to enroll in Medicare Part B coverage. For example, if you are still receiving healthcare coverage through your employer, you may postpone enrolling in Part B. Remember, if you have creditable coverage in place, you will not face penalties for enrolling in Medicare Part B after your Initial Enrollment Period.

Do I Need Medicare Part B to Get Additional Medicare Coverage?

If you plan to enroll in a Medicare Advantage or Medicare Supplement plan, you will have to be enrolled in both Medicare Part A and Part B. This means you will still need to pay your Part B premium in addition to the monthly premium for your Medicare Advantage or Medigap plan.

However, if you wish to enroll in a Medicare Part D prescription drug plan, then having Part B is not mandatory; you only need to be enrolled in Part A to receive a drug plan through Medicare.

Do You Need Help with Medicare Part B Coverage?

Unsure of which services are considered outpatient and which are considered inpatient? Trying to figure out how Medicare Part B costs impact your budget? Give us a call and speak with one of our licensed agents.

In addition to speaking to an agent, you can also learn more about Medicare Part B by checking out the links below. We have a library of educational Medicare articles to help individuals get a better understanding of how Medicare works.

Interested in enrolling in Medicare Part B? Learn how to apply for Medicare Part B here.

Learn which medical and outpatient services are covered under Medicare Part B.

Medicare Part B Premiums can cost more depending on your income. Learn more here.

Sources

Parts of Medicare, Medicare. Accessed June 2023.

https://www.medicare.gov/basics/get-started-with-medicare/medicare-basics/parts-of-medicare

Medicare and You Handbook 2023, Medicare. Accessed June 2023.

https://www.medicare.gov/publications/10050-Medicare-and-You.pdf

Original Medicare (Part A and B) Eligibility and Enrollment, Centers for Medicare & Medicaid Services. Accessed June 2023.

https://www.cms.gov/medicare/eligibility-and-enrollment/origmedicarepartabeligenrol