Summary: Understanding the different parts of Medicare helps ensure you get the right coverage you need for your health and budget. Medicare is made up of four parts: Part A, Part B, Part C, and Part D. Learn what coverage each part of Medicare provides. Estimated Read Time: 5 min

What are the Parts of Medicare?

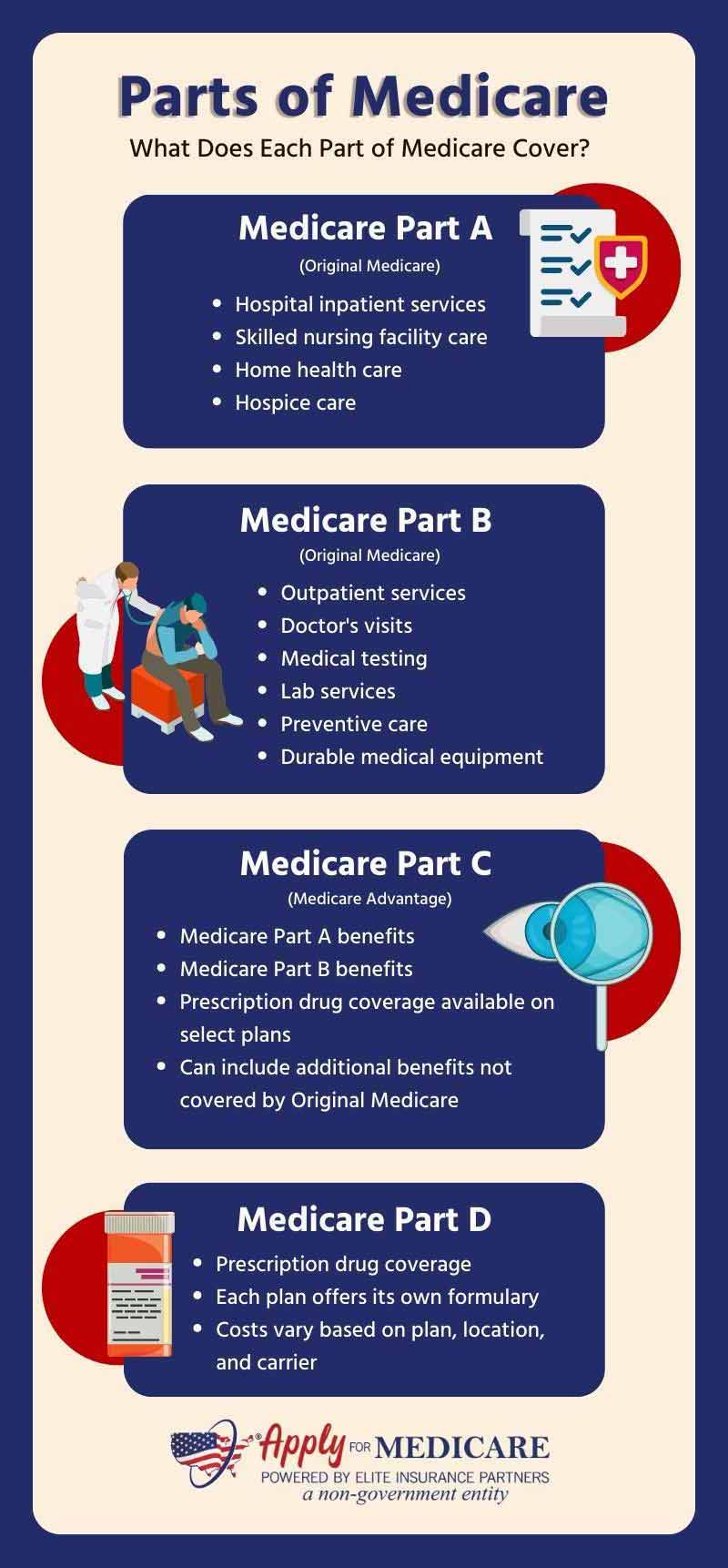

Medicare consists of four main parts: Part A, Part B, Part C, and Part D. These different parts of Medicare provide separate coverages and have their own costs. It’s important to understand each part so you can make an informed decision about which coverage is best for you.

Medicare Parts A and B make up Original Medicare, which is offered by the federal government. Original Medicare provides hospital and medical insurance. You can use your Original Medicare coverage at any healthcare provider in the United States who participates in Medicare.

Original Medicare covers most medically necessary services and supplies. However, it does not include dental, vision, hearing, or prescriptions. For those additional coverages, beneficiaries can choose to pair their Original Medicare with a Medicare Part D Prescription Drug Plan or a Medicare Supplement Plan.

Instead, you can receive your Original Medicare benefits through Medicare Part C (Medicare Advantage plans). Medicare Part C plans include Part A and Part B coverages, but may include additional coverage such as prescription drug coverage. These bundled plans may be a better option for some beneficiaries depending on their medical and financial needs.

Medicare Part D provides prescription drug coverage and is issued by private insurance companies. After enrolling in Medicare Part A, a beneficiary may choose to enroll in a Part D plan.

Refer to the Medicare parts chart below to learn more about Medicare Parts A, B, C, & D:

| Medicare Part | Coverage | Offered By |

|---|---|---|

| Part A (Hospital Insurance) | Hospital inpatient care, skilled nursing facility, hospice, and home healthcare | Federal/State |

| Part B (Medical Insurance) | Doctor’s visits, outpatient care, and durable medical equipment | Federal/State |

| Part C (Medicare Advantage) | All-in-one plans that combine hospital, medical and sometimes prescription coverage. Can offer additional benefits | Private Insurance company |

| Part D (Prescription Drug Plan) | Helps cover costs of prescription drugs | Private Insurance company |

Medicare Part A: Hospital Insurance

Medicare Part A provides hospital insurance for beneficiaries. This coverage includes hospital inpatient care, skilled nursing facility care, hospice, and home healthcare. You can use your Part A benefits at any qualified health care provider in the US who participates in the Medicare Program and is accepting Medicare patients.

Examples of Part A Coverage:

- Care in special units, such as the intensive care unit at a hospital

- Hospice care of the terminally ill, including medications to manage symptoms

- Part-time, skilled care for the homebound

Many people qualify for a $0 Part A premium. If you or your spouse worked 10 years (or 40 quarters), you will be eligible for premium-free Part A.

Medicare Part B: Medical Insurance

Medicare Part B helps pay for doctor’s visits, outpatient care, and durable medical equipment. Below are some, but not all, examples of services that Medicare Part B helps cover:

- Doctor’s visits

- Durable medical equipment (like wheelchairs, walkers, and more)

- Lab services such as blood tests

- Physical, occupational, and speech-language pathology services

Like Part A, you can use your Medicare Part B at any health care provider in the US who accepts Medicare.

When using your Part B coverage, you’ll typically pay 20% of the Medicare-approved amount after you meet your deductible. Additionally, you will also need to pay a monthly premium for Part B that is based on your annual income.

Medicare Part C: Medicare Advantage

Medicare Part C, or Medicare Advantage Plans, are another way you can receive your Medicare Part A and B coverage. Medicare Part C Plans are Medicare-approved plans offered by private insurance companies. They must offer benefits at least equal to Medicare Parts A and B, but may include additional benefits.

Some reasons people choose to enroll in a Medicare Part C plan include:

- Part C plans may have lower out-of-pocket costs than Original Medicare

- Plans may offer additional coverage and services

- Medicare Advantage Prescription Drug (MAPD) plans have medical and prescription coverage included

Medicare Part D: Prescription Drug Plan

Medicare Part D prescription drug plans help cover the cost of prescription drugs. Medicare Part D is optional and is issued by private insurance companies that follow rules set by Medicare. You can obtain drug coverage by enrolling in a Medicare Part D plan in addition to Original Medicare, or by enrolling in a Medicare Advantage plan with drug coverage.

Medicare Part D plans each have a list of drugs they cover, called a formulary. The formulary will contain both brand name and generic drugs divided into tiers. These tiers each have different costs; for example, a drug in a lower tier will typically cost less than a drug in a higher tier.

What Parts of Medicare do I Need?

It’s important to understand that everyone has different healthcare and budget needs. When it comes to choosing Medicare coverage, you should consider your own personal needs and select an option that works best for you.

Since every person’s needs are different, Medicare coverage is flexible. For example, you can get Part A without getting Part B. Someone may choose to do this if they are working past age 65 and receiving health insurance through their employer.

Although less common, some people may get Part B coverage without getting Part A coverage. This may occur when an individual is not eligible for premium-free Part A and does not want to pay for hospital insurance.

If you want to enroll in a Medicare Part C plan, or a Medicare Supplement Plan, you will need to enroll in Original Medicare first. If you need prescription drug coverage, you must get a MAPD (Medicare Advantage Prescription Drug) plan, or a Medicare Part D plan.

Remember: Enrolling in Medicare once you become eligible is optional, however if you wait to enroll past your Initial Enrollment Period, you could be subject to penalties.

How to Learn More About the Four Parts of Medicare

Making Medicare easier to understand is our goal at Apply for Medicare. We hope this overview of the four main components of Medicare has helped you learn more about Medicare coverage. If you are unsure which Medicare coverage is best for you, or have questions about the different parts, give us a call. At Apply for Medicare, we have a team of licensed insurance agents who are ready to help you with understanding Medicare and its parts.

Sources

Parts of Medicare, Medicare. Accessed June 2023. https://www.medicare.gov/basics/get-started-with-medicare/medicare-basics/parts-of-medicare

Medicare and You, Medicare. Accessed June 2023. https://www.medicare.gov/publications/10050-Medicare-and-You.pdf

FAQs Category: Medicare and Medicaid, U.S. Department of Health and Human Services. Accessed June 2023 https://www.hhs.gov/answers/medicare-and-medicaid/index.html