Summary: Having prescription drug coverage when you’re enrolled in Medicare can significantly reduce your out-of-pocket-costs. In this article, we’ll discuss your options for receiving Medicare drug coverage, and why having drug coverage is important. Additionally, we’ll review which medications and vaccines are covered by Medicare Part D. Estimated Read Time: 7 min

How Prescription Drug Coverage Works with Medicare

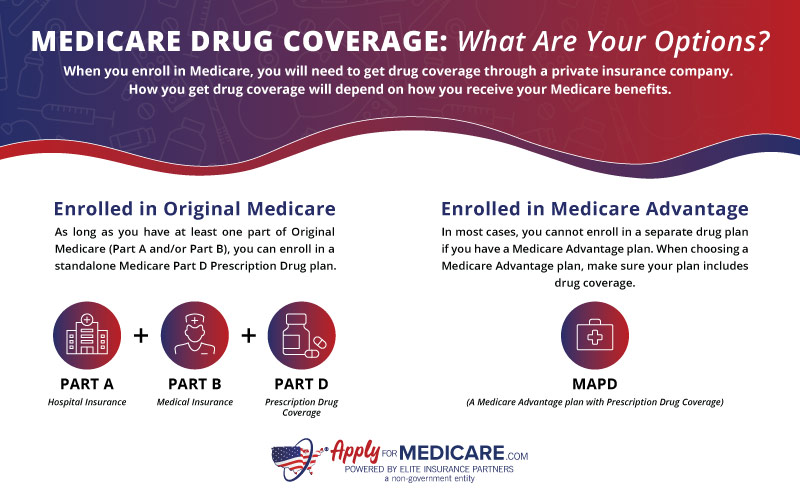

You may be surprised to learn that Original Medicare, the portion of Medicare provided by the federal government, does not include prescription drug coverage. When you enroll in Medicare, you will need to get drug coverage through a private insurance company. Depending on how you are receiving your Medicare benefits, you will need to get drug coverage (Medicare Part D) in one of two ways.

Drug Coverage for Original Medicare Enrollees: To get prescription drug coverage when enrolled in Original Medicare, you will need to get a Medicare PDP. A Medicare Part D Prescription Drug Plan, also known as a Medicare PDP, is a standalone drug plan that helps cover the cost of prescription drugs and vaccines. These plans are offered by private insurance companies and can be paired with Original Medicare to help reduce your costs for medications.

Drug Coverage for Medicare Advantage Enrollees: If you have a Medicare Advantage plan instead of Original Medicare, you can get drug coverage by ensuring your Medicare Advantage plan is a MAPD plan. MAPD plans are Medicare Advantage plans that include prescription drug coverage. Enrolling in a plan that includes drug coverage can help reduce your costs and ensure you do not incur a late enrollment penalty if you choose to get drug coverage later.

All Medicare drug plans, whether a PDP or MAPD plan, must follow coverage rules set by the Centers for Medicare & Medicaid Services. Below, we’ll discuss which medications and vaccines are covered by Medicare Part D.

Which Medications are Covered Under Medicare Part D?

Medicare Part D prescription drug plans must cover a wide range of brand-name and generic prescription drugs. Additionally, they must include coverage for all drugs in certain protected classes including immunosuppressants, antidepressants, antipsychotics, anticonvulsants, antiretrovirals, and antineoplastics. This includes coverage for drugs used to treat HIV/AIDs and anticancer drugs.

Each prescription drug plan provides a list of covered drugs known as a formulary. Medications covered under your prescription drug plan will be divided into tiers, which will determine how much your copayment will be for each drug. Typically, covered drugs in lower tiers will cost less than drugs in higher tiers.

If you are prescribed a medication that is not covered under your Medicare RX plan, and there is no alternative, you can ask for a coverage exemption from your plan provider. However, there is no guarantee that your plan will approve your request; in such a case, you will be responsible for paying the full cost of the medication out-of-pocket.

Coverage Rules for Prescription Drug Plans

Some Medicare prescription drug plans have coverage rules for certain drugs on their formulary. Coverage rules will vary from plan to plan and may not apply to the same drugs. Below are some common types of coverage rules you may see when reviewing your Part D formulary.

- Prior Authorization – you or your doctor may need to contact your plan and get prior authorization before the prescription can be filled.

- Quantity limits – some drugs may have limits on how much medicine you can get at a time.

- Step therapy – you may need to try one or more similar, lower-cost drugs before the plan will cover the more expensive drug.

This is not a complete list of coverage rules. Your plan’s Evidence of Coverage will detail any coverage restrictions or rules that your drug plan may have.

Medicare Drug Coverage for Insulin

Medicare Part D provides coverage for insulin including:

- Insulin that is injected

- Insulin used with a disposable insulin patch pump

- Insulin that’s inhaled

- Certain supplies used to inject insulin (syringes, gauze, alcohol swabs)

If you use a traditional insulin pump, your insulin will instead be covered under your Medicare Part B benefits.

As of January 1st, 2023, Medicare drug plans cannot charge you more than $35 for a one-month supply of insulin. You also do not need to meet your plan’s deductible before receiving coverage for insulin. Though the cost of insulin is capped, it is important to remember that prescription drug plans are not required to cover all types of insulin. You will still want to review your plan’s formulary carefully to ensure that the insulin you use is covered.

Medicare Part D Coverage for Vaccines

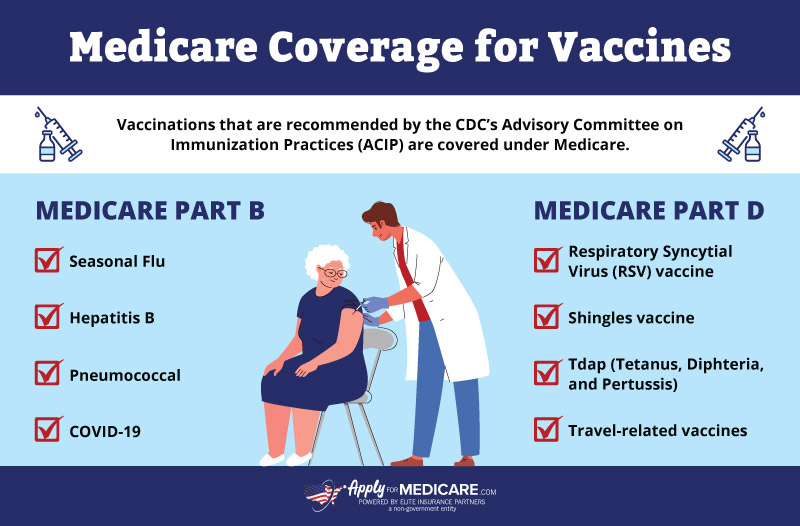

Since January 1st, 2023, Medicare Part D plans are required to cover most vaccines with no out-of-pocket costs. Vaccinations that are recommended by the CDC’s Advisory Committee on Immunization Practices (ACIP) are covered entirely, so you will not be responsible for paying a copayment or deductible.

Coverage for vaccines is split between Medicare Part B and Medicare Part D. Some vaccines, such as the COVID-19 vaccine, will be covered by your Medicare Part B coverage.

Vaccines That Medicare Part D Covers:

- Respiratory Syncytial Virus (RSV) vaccine

- Shingles vaccine

- Tdap (Tetanus, Diphtheria, and Pertussis)

- Travel-related vaccines

The above list is not a complete list. Review your plan coverage documents for more information.

In May of 2023, the FDA approved the first RSV vaccine for adults over the age of 60. This vaccine is included on the CDC’s list of recommended vaccines for adults, and therefore, is covered under all Medicare drug plans. If the RSV vaccine is not yet listed on your plan’s formulary, you can request a coverage exception from your plan’s provider. Additionally, you can pay for the vaccine out-of-pocket and request a reimbursement from your plan.

If your plan denies your request, or your pharmacy tries to charge you for the RSV vaccine when you have Medicare Part D, you can contact Medicare at 1-800-633-4227 for assistance.

There are some vaccines that are only recommended for individuals who are traveling to specific regions of the world. The Centers for Disease Control and Prevention provides a list of possible vaccines you may need to get before traveling. Almost all travel-related vaccines are included on the list of Vaccine-Specific ACIP Recommendations, and therefore, must be covered by Medicare. This includes vaccines for Japanese encephalitis, Yellow fever, Typhoid, and more.

What Isn’t Covered Under Medicare Part D?

Though Medicare Part D Prescription Drug plans cover a variety of medications, there are certain types of drugs that are excluded from coverage under the Medicare Part D program. This includes drugs such as:

- Nonprescription drugs

- Medications used for anorexia, weight loss, or gain

- Medications used to promote fertility

- Drugs used for cosmetic purposes

- Medications used for symptomatic relief of colds and cough

- Drugs when used for the treatment of sexual or erectile dysfunction

- Prescription vitamins and mineral products (excluding prenatal vitamins and fluoride preparations)

Sometimes it can be difficult to know which drugs are excluded or restricted from coverage. For example, Medicare Part D plans cannot cover Wegovy, since it is only FDA approved for weight loss. Ozempic, on the other hand, can be covered by Medicare Part D because it is FDA approved to treat Type 2 Diabetes. Though the two medications have the same active ingredient, only Ozempic meets the definition of a Part D drug because it is prescribed for a medically accepted condition.

Medicare drug plans may include some of the restricted drugs mentioned above if they are FDA approved for treating a covered condition. As an example, a drug may not be covered if it is prescribed to treat erectile dysfunction. However, that same drug may be covered if it is prescribed to treat pulmonary hypertension.

The Centers for Medicare & Medicaid Services has an Excluded Drug Reference File Frequently Asked Questions that is updated regularly with information regarding restricted drugs. If you’re unsure if a drug is covered under your plan, review your formulary or contact your plan provider.

Why Having Drug Coverage with Medicare Matters

It may seem like a hassle to spend time finding and comparing your options for receiving drug coverage while on Medicare, but it matters. Having drug coverage while enrolled in Medicare can greatly reduce your out-of-pocket costs when it comes to medications. Enrolling in drug coverage as soon as you become eligible can also help you avoid having to pay the Medicare Part D late enrollment penalty down the road.

Though there are other ways for seniors to save money on drug costs, having a Medicare prescription drug plan can save you a significant amount of money, especially on more expensive drugs. In fact, the 2022 Inflation Reduction Act gave Medicare the ability to negotiate prescription drug prices directly with drug companies. The first round of drugs selected for price negotiations was announced in 2023 and includes drugs like Eliquis, Jardiance, Xarelto, and more. Successful negotiations will result in lower prices for the selected drugs for all Medicare drug plans.

If you have questions regarding Medicare drug coverage and would like to speak with a licensed insurance agent, give us a call at the number above. You can also check out our related articles below for more information.

Sources

5 Things to Know About Medicare Insulin Costs, Centers for Medicare & Medicaid Services. Accessed January 2024

https://www.medicare.gov/media/publication/12172-medicare-insulin-costs-facts.pdf

ACIP Vaccine Recommendations and Guidelines, Centers for Disease Control and Prevention. Accessed January 2024

https://www.cdc.gov/vaccines/hcp/acip-recs/index.html

Medicare & You 2024 The Official U.S. Government Medicare Handbook, Medicare.gov. Accessed January 2024

https://www.medicare.gov/publications/10050-Medicare-and-You.pdf

HHS Selects the First Drugs for Medicare Drug Price Negotiation, U.S. Department of Health and Human Services. Accessed January 2024